Greater Vancouver is the least affordable place in Canada to buy property on a single income, according to a new study conducted by Toronto-based real estate brokerage Zoocasa, and Victoria isn’t far behind.

If you ever dreamed of buying property on your own — without a partner, without a co-ownership arrangement, without family support — Greater Vancouver is definitely not the place to do it.

Greater Vancouver is the least affordable place in Canada to buy property on a single income, according to a new study conducted by Toronto-based real estate brokerage Zoocasa.

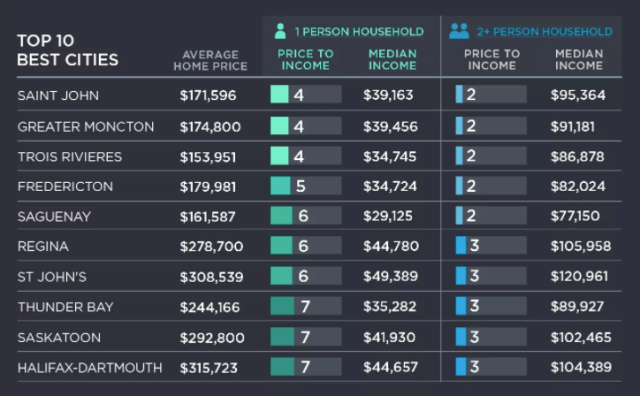

The most affordable? Saint John or Greater Moncton in New Brunswick, or Trois Rivieres in Quebec.

Using February 2018 home price data from the Canadian Real Estate Association and median household income data from Statistics Canada, the study calculated each city’s home-price-to-income ratio by looking at how many years it would take to pay off the average home if a buyer contributed the equivalent of 100 per cent of their annual income to the purchase price.

Of course, if you don’t already have the equivalent saved up, it’s not realistic to contribute all of your annual income into a home purchase, but this affordability measure does show where in Canada purchasing a home might be easier on a single-income household. The higher the ratio, the longer it would take to pay down the home.

The top three most affordable places to purchase a home on a single income were Saint John, N.B.; Greater Moncton, N.B.; and Trois Rivieres, Que., all tied with a ratio of 4.

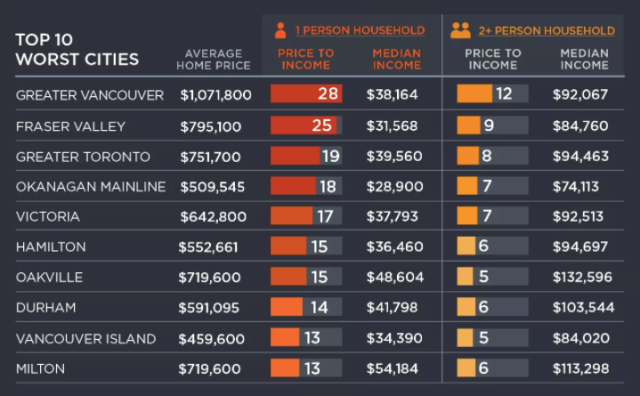

Meanwhile, the top three least affordable places to purchase a home on a single income were Greater Vancouver, B.C.; Fraser Valley, B.C.; and Greater Toronto, Ont., with ratios of 28, 25 and 19, respectively. Greater Victoria’s ratio of 17 made it the fifth least affordable, while Vancouver Island’s ratio of 13 placed it as ninth least affordable.

“Financial experts commonly recommend restricting shelter costs to just three times one’s annual income — however, this is outstripped by even the most affordable market in Canada,” according to the study.

“Owning the average-priced home of $171,596 in Saint John, N.B., on the regional median income of $39,163, would still require 4 times the homeowner’s annual earnings.”

On a double income, Greater Vancouver’s home-price-to-income ratio is still 12, while the Fraser Valley’s ratio is 9.

A number of cities on the most affordable list, however, do fall within the parameters of the old guideline, with Saint John and Greater Moncton, N.B.; Trois Rivieres, Que.; Fredericton, N.B. and Saguenay, Que. all coming in with a ratio of 2.

The 5 Most Affordable Home Markets

• Saint John: 4 (average home price: $171,596, median one-person income: $39,163)

• Greater Moncton: 4 (average home price: $174,800, median one-person income: $39,456)

• Trois Rivieres: 4 (average home price: $153,591, median one-person income: $34,745)

• Fredericton: 5 (average home price: $179,981, median one-person income: $34,724)

• Saguenay: 6 (average home price: $161,587, median one-person income: $29,125)

The 5 Least Affordable Home Markets

• Greater Vancouver: 28 (average home price: $1,071,800, median one-person income: $38,164)

• Fraser Valley: 25 (average home price: $795,100, median one-person income: $31,568)

• Greater Toronto: 19 (average home price: $751,700, median one-person income: $39,560)

• Okanagan Mainline: 18 (average home price: $509,545, median one-person income: $28,900)

• Victoria: 17 (average home price: $642,800, median one-person income: $37,793)