Last week my wife and I received identical letters from the B.C. Finance Ministry, telling each of us that we owed $11,710.

What these amounted to were unsupported demands for payment, followed by an ultimatum: “The entire balance of your account is due and payable immediately.”

And why do we each owe $11,710? Because we might be liable under the Speculation and Vacancy Tax Act.

Are we in fact liable? No, but here’s the deal.

The government doesn’t have to prove you owe this tax. It falls to you to prove you don’t. This is a complete inversion of due process that, I want to argue, invalidates the tax.

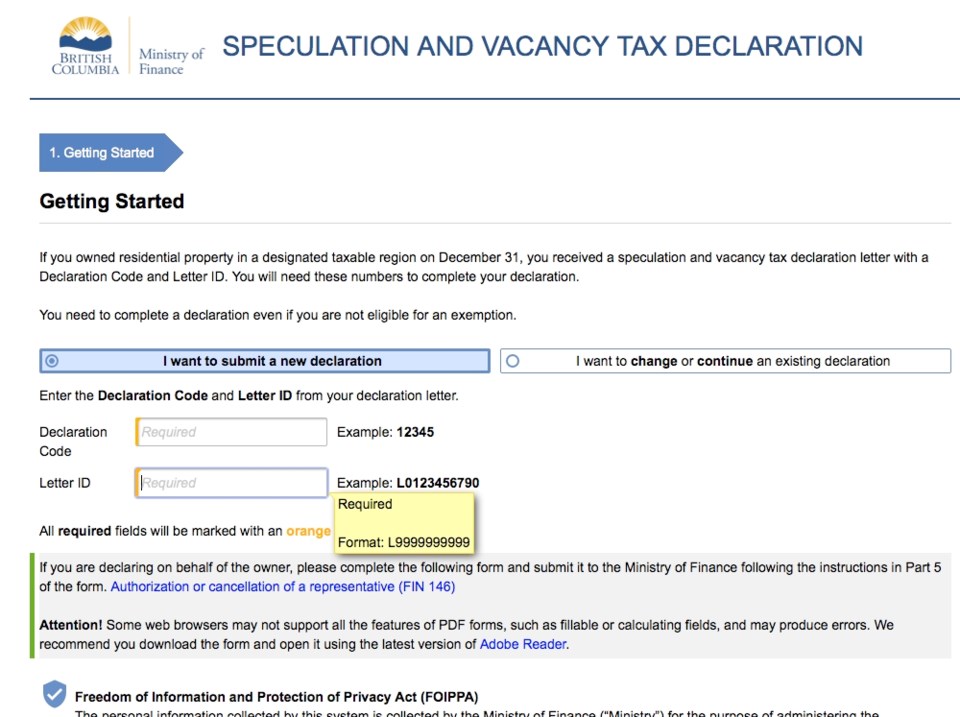

It works like this. Homeowners are now obliged to submit an annual declaration, testifying that the home in question is their primary residence, or if it was vacant over the preceding year, that they rented it for at least three months.

Supposedly you get a missive in the mail telling you to complete this declaration, though I don’t recall ever receiving one, and neither does my wife. But that’s not the point.

Nothing in this invoice reminds you of that obligation. It doesn’t explain the Act. It doesn’t advise you that in all likelihood you are not liable (99 per cent of home owners are not, in itself a mockery of this rigmarole).

It doesn’t tell you under what circumstances you would be liable. It doesn’t tell you how the amount “owing” is calculated.

In short, it ignores the possibility of an innocent oversight, and proceeds straight to a bare-faced pay-up-or-else.

I’m willing to bet there are numerous folks out there, some of them perhaps elderly, who assume that if Finance Minister Carole James tells them they owe money, then they do.

Now it might be argued, well wait a minute, if we were instructed to complete a form and did not, that’s hardly the ministry’s fault.

I disagree. There is a basic issue here around what constitutes a bona fide tax.

Before governments reach into your wallet, they’re obliged to inform themselves of what is owing.

Suppose the federal government wants to tax your income. It must first sequester various records, to establish how much you earned.

Suppose the provincial government wants to tax the sale of alcohol or gasoline. It must instruct liquor outlets and gas bars to add that tax at the point of purchase, meaning the transaction is duly recorded and verifiable when the sale takes place.

Suppose a municipality wants to impose a property tax. It must first consult the registry maintained by the B.C. Assessment Authority, to determine what your home is actually worth.

In each of these cases, the onus is on government, not on you, to establish that the tax is owing, and that payment has been properly demanded. There is a reason for this.

The power to tax, like the power to imprison, is open to abuse. In the latter instance, we demand due process be followed, by requiring the Crown to prove its case. That is to say, you are presumed innocent until proven guilty.

This longstanding presumption of innocence, embedded in the Charter, gives legitimacy to what would otherwise be a naked use of power. It is this presumption the ministry seeks to discard, and has indeed discarded.

For here the process is reversed. It’s not up to government to prove you are guilty (i.e. that you owe the tax). It is up to you to prove your innocence. I can think of no statutory precedent for such an arbitrary imposition.

Moreover, to satisfy this requirement, you are immersed in a swamp of bureaucratic fuddle duddle. You might have to fill in form FIN 146, authorizing or cancelling a representative.

Then there is form FIN 561, noting a spousal transfer of income, a treatment certification (whatever that is), a separate residence medical certification, and on and on. In total, it takes the Act more than 10,000 words to define the various circumstances in which you might or might not owe money.

This is an unaccountable and spurious methodology that, by its very nature, can only lead to confusion and overpayment.

If Clarice from Portugal sends you an email promising to sic the RCMP on you unless she receives a bag of cash, we’d call that a scam. Likewise here.