The variability of investment returns can have a material impact in the early years of investing. Over time, the variability of returns is smoothed out. There are methods and strategies to reduce the variability for investors who have cash and want to get these funds invested.

Over the years, we have received hundreds of calls from individuals who have accumulated significant savings, sold a business or home, or received an inheritance. All have the same desire to protect the capital and get a satisfactory rate of return.

Timing in the short term

For the most part, the timing of when funds are received by clients may or may not be ideal with respect to where the equity market cycle is positioned — that part can not always be controlled. However, the timing of getting funds invested can be controlled and managed by a Portfolio Manager.

Long-term returns

Canada in review

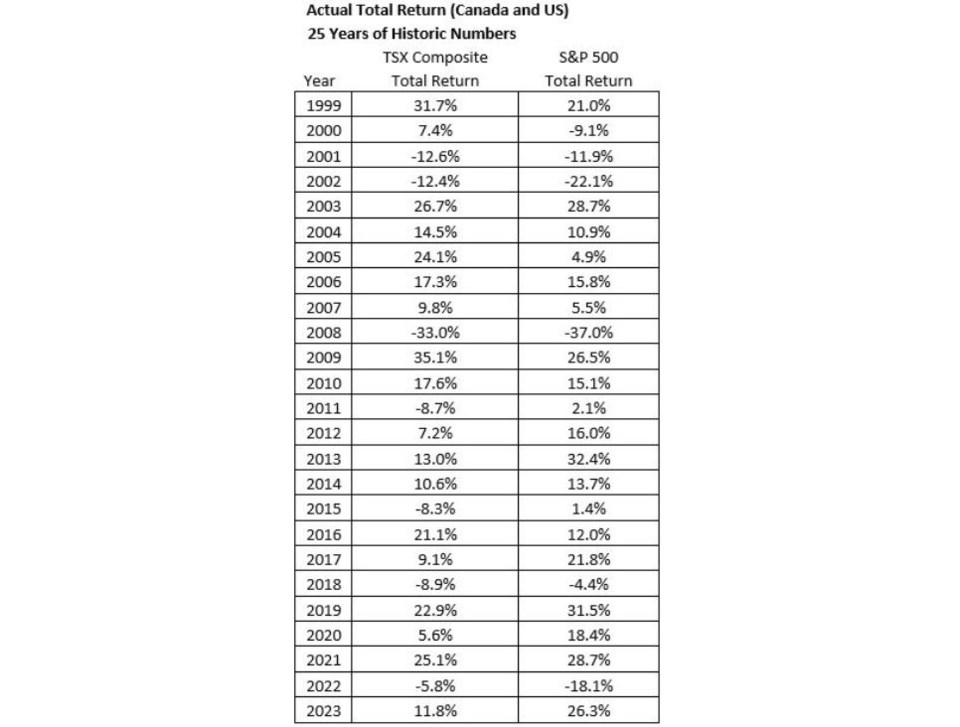

In the past 25 years, there have been seven years in which the S&P/TSX Composite Index posted declines and 18 years in which there were positive returns. We also noted the extremes of a loss of 33 per cent in 2008, and a gain of 35.1 per cent in 2009.

The above information reinforces something we already know: The stock market does not move in a straight line. The total cumulative rate of return during this 25-year period is 517 per cent. This equates to an annualized 7.55 per cent return over the last 25 for the TSX Composite Index.

United States in review

In the past 25 years, there have been six years where the S&P 500 posted declines and 19 years in which there were positive returns. We also noted the extremes of a loss of 37 per cent in 2008, and a gain of 32.4 per cent in 2013. The total rate of return during this 25-year period is 519 per cent. This equates to an annualized 7.56 per cent return over the last 25 within the S&P500.

The stock market has provided solid long-term returns in both Canada and south of the border. Establishing a geographically diversified and disciplined long-term approach helps overcome short-term variable returns.

Variable returns in the short term

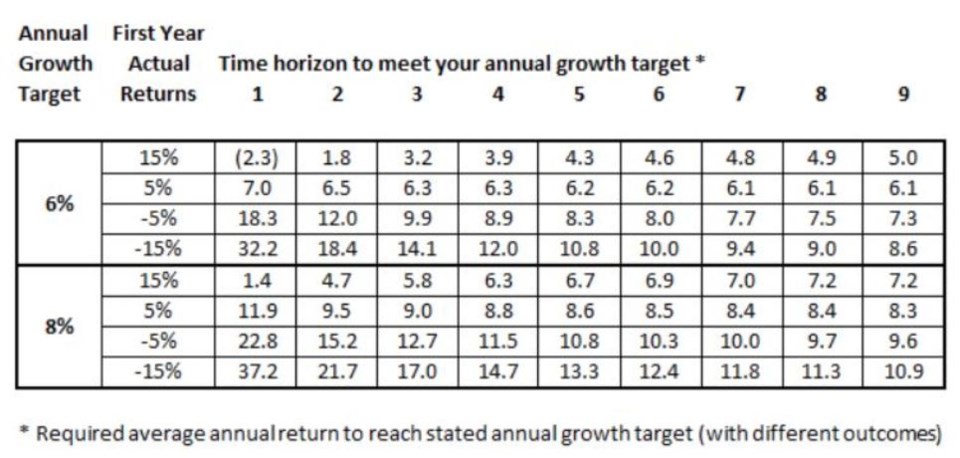

To see how both positive and negative years in the equity markets impacts your portfolio in the short term, we have developed the Greenard Group Variability Chart which we have published multiple times over the years. The table below shows how the first-year actual investment returns impact the required average annual returns to reach annual short-term growth targets of six and eight per cent.

Greenard Group Variability Chart

If the above chart was stretched out over a 25-year time horizon the variability of the first-year returns would have an even smaller impact.

First year of investing

An investor who began investing in early 2010 may have a significantly different outcome than an investor who began investing at the beginning of this year. When we have new clients with a lump sum to invest, we communicate the importance of reducing market risk.

Market risk is simply the risk of the market pulling back — it is not specific to any one security. With the rise in exchange-traded funds and mutual funds, when investors are selling, all constituents of these structured investments will decline.

Components to manage market risk

The strategy of how to manage market risk is dependent on many components. The three main components include:

• What stage of the market cycle we are in;

• Client’s net worth, cash flow needs, and risk tolerance; and

• Age, time horizon, and past investment experience.

The Greenard Group approach is customized to each client. We have provided a few examples below.

Sandra Smith

At the end of 2019, we received a call from Sandra. She was referred to us by a friend that is a client of ours. Sadly, she lost her husband during the year who had been handling the finances. In addition, she received $750,000 as a lump sum payout from an insurance company.

Assessing the three main components above:

• Sandra came to see us at the end of 2019 with markets at historic highs.

• Net worth was high — excluding principal residence the investable assets were $1.6 million.

• Other income sources were low, cash flow needs were high, and risk tolerance was medium.

• Sandra was 59, wanted to plan to age 95, and had limited investment knowledge.

The components mapped out for Sandra involved preparing a financial plan, ensuring she prepared a summary of her cash flow needs/budget, focusing on low beta dividend paying stocks, and getting the funds invested over time.

On the first meeting, we invested only 25 per cent of the cash to get the baseline core names in the model portfolio and to start receiving dividend income. We also mapped out a plan of what the portfolio will look like once fully invested. As Portfolio Managers, we have the discretion to react quickly if market opportunities present themselves.

Heather and Thomas White

Heather and Thomas sold their house for $1.3 million in December 2021 to capitalize on the hot housing market. They decided to rent and not buy back into the real estate market. Heather and Thomas already had $1 million invested in non-registered, TFSA and RRIF accounts.

Assessing the three main components above:

• Heather and Thomas came to see us at the end of 2021 — markets were again at an all-time high.

• Net worth was high with investable assets at $2.3 million.

• Other income sources were moderate (registered pension plan, CCP and OAS), and cash flow needs were moderate-to-high as they required cash flow to pay rent and to travel.

• They had over 20 years of investment experience, high investment knowledge, and a moderate risk tolerance.

• Heather and Thomas were both 78 and wanted to plan for at least one of them living to age 95.

The components mapped out for Heather and Thomas involved updating their retirement financial plan for the recent sale of the house. The plan required us to send $10,000 automatically every month from their investment account to their bank account. We set aside $240,000 into a special money market ear-marked for their cash flow needs for two years — we refer to this as a cash wedge.

We added some of remaining amount to the existing investments, which involved restructuring the placement of the investments and position sizes. The discussions also focused on tax efficiency and generating stable income to replenish the cash wedge for the monthly withdrawals.

Given that markets were at an all time high, and they had an existing portfolio already, we invested only 25 per cent of the lump sum deposit. Our advice was that if the markets pulled back, we would view this as an opportunity to get the remaining funds invested. Within six months, we were able to get 75 per cent of the cash invested.

John Johnston

John was a dentist who had recently sold his dental practice for $2 million. He was still planning to work for another three years. His other investments were primarily in real estate. John had moderate knowledge of financial investments.

Assessing the three main components above:

• John came to see us in 2022 — markets had pulled back substantially.

• Net worth was high, excluding principal residence the investable assets were $2 million.

• Other income sources were high, there were no cash flow needs from the portfolio for three years, and John had high risk tolerance.

• John was 54, wanted to plan to age 90, and had moderate investment knowledge.

The components mapped out for John involved preparing a retirement financial plan. John was planning to make further deposits into his investment accounts over the next three years, did not require any cash flow from the investments in the short term, and wanted to focus on capital growth.

During the first meeting, given the stage of the market cycle, we invested 50 per cent of the cash to get the baseline core names in the portfolio, and to position the portfolio for growth. We also mapped out a plan of what the portfolio would look like once fully invested; taking into consideration that John would be making ongoing large deposits that would also need to be invested over time.

Our recommendations were aided by the fact that in addition to his professional income, he had stable rental income that would support his cash flow needs.

Kevin Greenard CPA CA FMA CFP CIM is a Senior Wealth Advisor and Portfolio Manager, Wealth Management with The Greenard Group at Scotia Wealth Management in Victoria. His column appears every week at timescolonist.com. Call 250.389.2138, email [email protected], or visit greenardgroup.com.