The Insurance Corp. of B.C. is using scare tactics to drum up business.

OK, so that’s not a big surprise. That’s what insurance companies do, often with pretty lifestyle scenes and upbeat music juxtaposed against something unpleasant, serving as a gentle nudge to buy more coverage. But ICBC is being pretty blatant about it with a few stark strokes of a marker. And it’s working, at least on me.

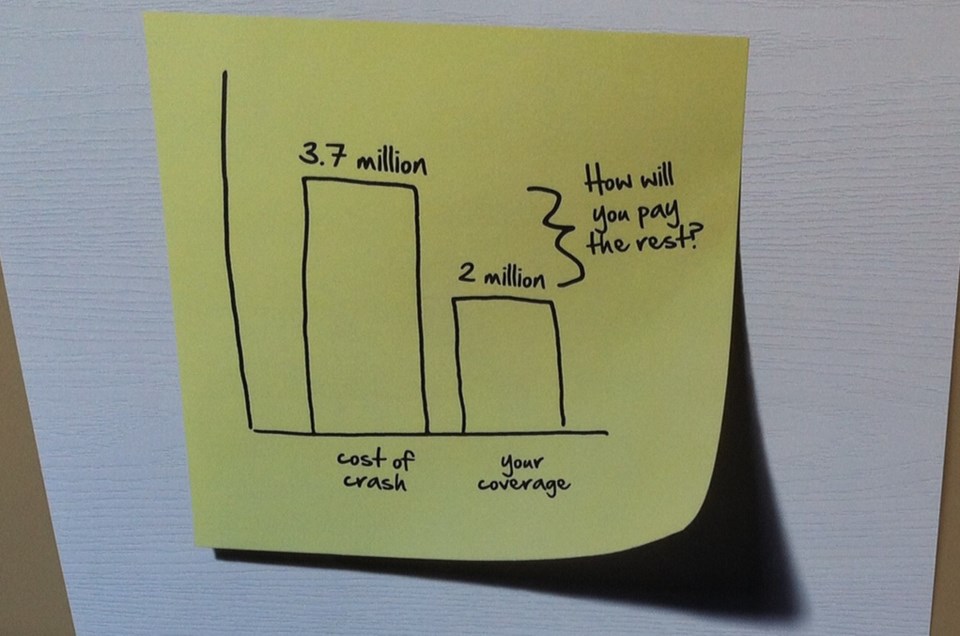

At ICBC agents’ offices, there’s a poster showing a picture of a yellow sticker with an informally-drawn bar graph, with these captions, referring to motor vehicle liability coverage.

Cost of crash, 3.7 million.

Your coverage, 2 million.

How will you pay the rest?

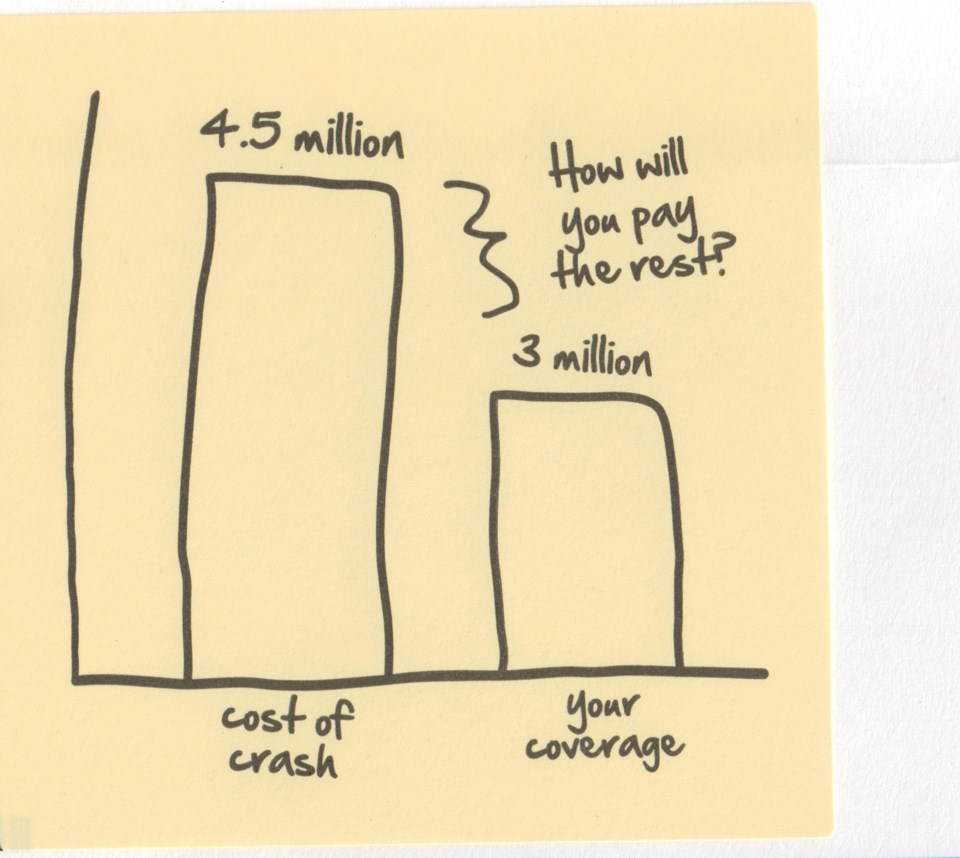

I already had $3 million of liability coverage, which my agent had described as typical. So, ICBC mailed me a semi-customized yellow sticker. It said:

Cost of crash, 4.5 million.

Your coverage, 3 million.

How will you pay the rest?

I knew I was being manipulated, but I succumbed. Upping liability coverage to $5 million cost an additional $47 a year.

I balanced it off somewhat by increasing the collision deductible to $500 from $300, which brought a $35 a year drop in premium cost. To be accurate, I am going to balance it off soon, since I was by myself when I visited the insurance agent’s office. Under ICBC rules, I can increase my liability coverage with a single signature. But to trim my collision coverage, they require the signatures of both owners.

It’s easy to spend more. Not as easy to spend less.

Here’s my imperfect reasoning for increasing liability coverage, formed under the influence of that threatening sticker.

I would have trouble affording an extra $2 million expense (the liability gap).

I would have less trouble affording an extra $200 (the higher deductible).

Your numbers are sure to be different, because insurance is complicated that way.

ICBC's scary sticky note for people with $3 million of liability coverage.

- - -

Email me at [email protected]

- - -

- - -

Most-popular posts:

Favourite meals at Victoria restaurants

Former con artist's advice: Don't use debit card to buy things

What you could do if you miss the last ferry back to Victoria

How to ride Vancouver transit with a Compass card

Eight years of riding an electric-assist bicycle almost every day

Why newer dishwashers run for an alarmingly long time

Most credit cards charge 2.5% for currency conversion; a few charge 0%

Why paying $720 for a phone can be a better deal than a 2-year contract

Tips to make applying for a passport a little easier

Do you know your Gulf Islands? Here's help memorizing 14 (of 200)

How to line up at busy Greater Victoria restaurants

To stay cool, leave house windows closed or open?

How to block unwanted text messages

Why B.C. Hydro bills sting more on Vancouver Island

How to pronounce Ucluelet, Tsawwassen, and that outdoor gear place

How to travel between Victoria and Vancouver on public transit

- - -