Residential real estate sales in the capital region continued sliding in September as the cooler market saw prices decline and inventory climb due to inflation and higher interest rates.

“This year sales have dropped month-over-month since May and we saw a reluctant September with some of the lowest sales numbers for that month in decades,” said Victoria Real Estate Board president Karen Dinnie-Smyth.

September is normally more active than summer months, she said Monday.

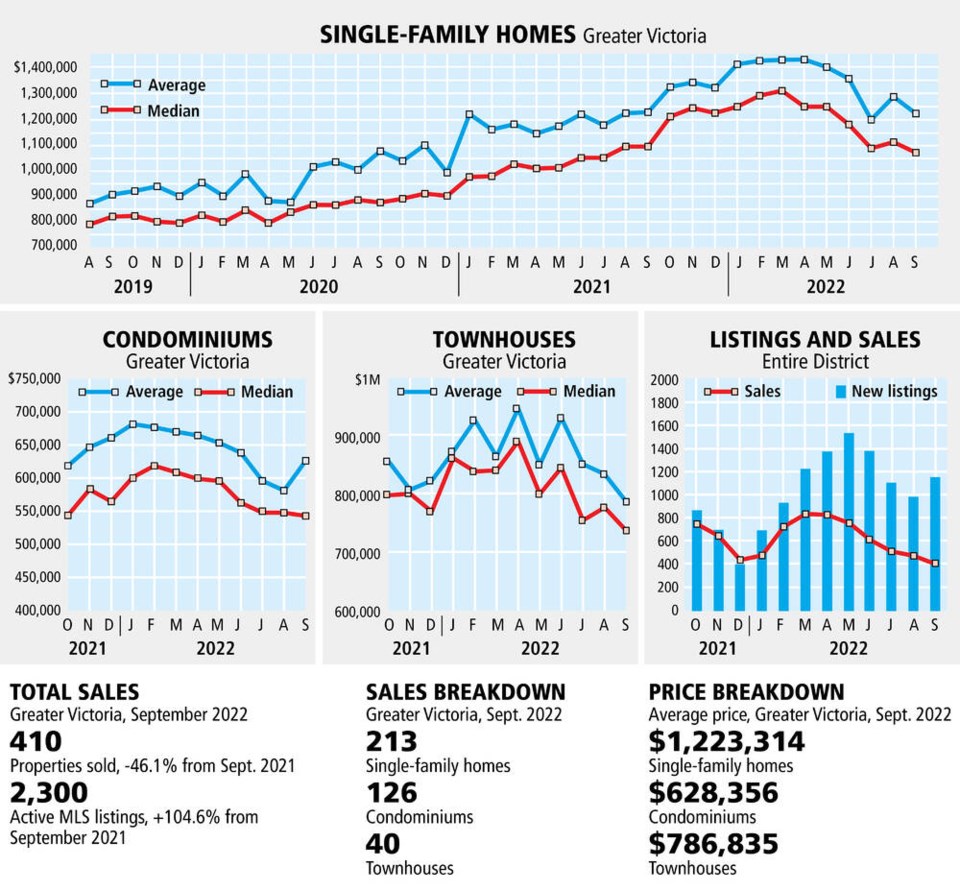

A total of 410 properties sold through the Victoria Real Estate Board’s multiple listing service in September. That’s down 14 per cent from August and 46 per cent from September 2021, when 761 properties changed hands.

Year-over-year, single-family house sales fell by 33.2 per cent to 221 sales in September. Condominiums sales softened by 58.8 per cent with 126 units sold for the same time period.

Dinnie-Smyth said the numbers do not necessarily reflect demand in the market: Well-priced properties get lots of attention and multiple offers are still quite common.

Alex Burns, owner-realtor at Re/Max Generation Uptown, said the market is generally becoming calmer.

A total of 440 Vancouver Island homes of all kinds saw price drops — typically between five and 10 per cent — between the end of August and the end of September, he said.

“Our market is definitely adjusting downward. It’s not a catastrophic adjustment.”

This provides buyers with more choice, more time to make a decision and the ability to put on conditions such as financing approvals and inspections.

“We just sold a house last week with no conditions so it is still happening — but very rare compared to the previous year,” Burns said.

Agents are also seeing more accepted offers with a two-week window to line up financing and get inspections done.

“It’s a better market to be in for everyone,” he said.

Additional breathing room gives buyers the chance to shop for the best mortgage and financing options, Burns said. Often sellers are buying again and they can take advantage of a calmer market.

There were 2,300 properties for sale through the Victoria Board as of the end of last month. That’s up 7.6 per cent from August and more than twice the 1,124 in September 2021.

Dinnie-Smyth and Burns agree that the inventory increase has contributed to a more balanced market in Greater Victoria.

Burns said, “If you are shopping for homes, you are going to see more inventory in the winter than you saw in the spring of last year.”

Buyers have more opportunity to choose a home that matches what they are looking for rather than look at just what is available, he said.

The single-family house market is seeing sellers move toward prices lower than $1 million to avoid being required to put down a larger down payment on a higher-priced house, Burns said.

The benchmark price for a single-family home in Greater Victoria’s core area was $1,364,200, a two per cent decline from August at $1,391,700. It remained above the $1,201,100 seen in September 2021.

Many buyers have turned to condos because they are priced out of the single-family market. September’s benchmark value for a condo in Greater Victoria’s core area was $617,400 last month, down by 0.7 per cent from August at $621,900. September last year was at $519,200.

Local municipalities are more open to allowing legal suites in homes, which can be used as a mortgage helper when buyers are seeking financing, Burns said.

Oak Bay council members, for example, vote unanimously last month in favour of bylaw changes which would permit a fully enclosed secondary suite in an owner-occupied home. It will also prohibit rentals of less than 30 days.