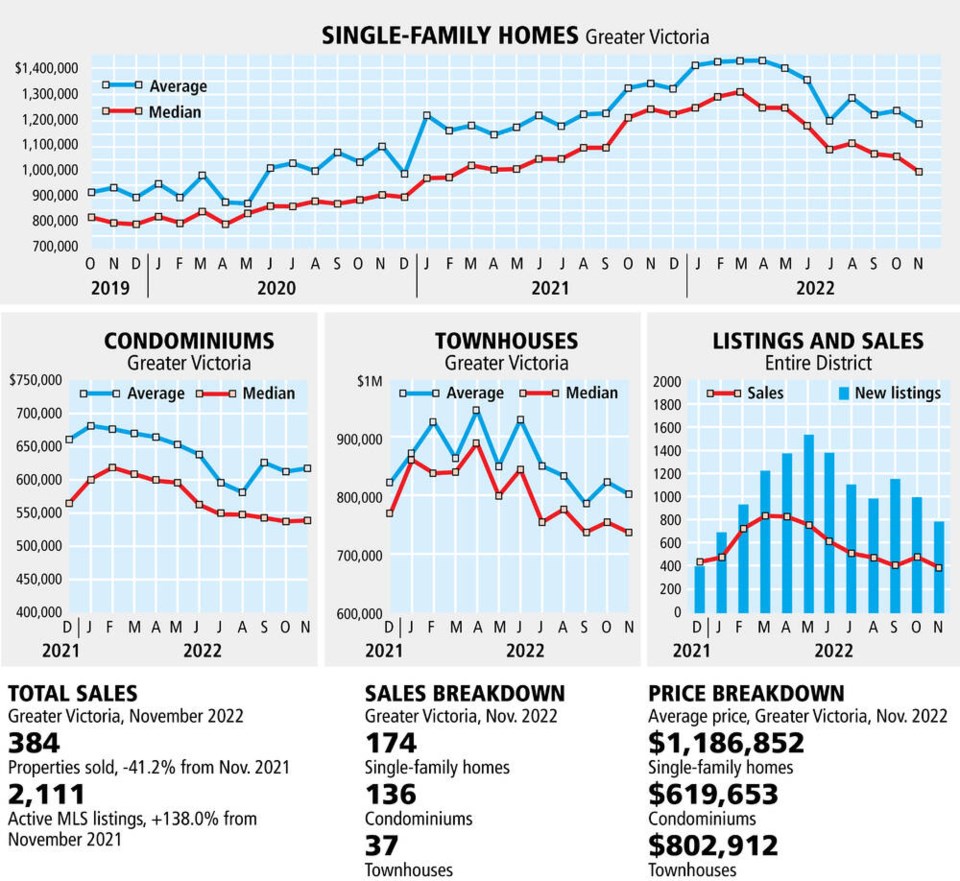

Sales volume dipped for Greater Victoria’s residential real estate market in November, with 384 properties changing hands.

It was a big drop compared with Novembers 2021 and 2020, when there were 653 and 795 property sales respectively.

Sale prices shifted last month, but depending on which measure you prefer, it either increased or decreased.

The median sale price of a single-family home in the region was $1 million last month, versus $1.25 million at the same time last year, while the median sale price of a condo dropped 7.5 per cent year over year to $541,000 and townhomes dropped 7.9 per cent to $737,450.

The benchmark value of a single-family home in the region, on the other hand, was $1.16 million last month up from $1.11 million last year. The Victoria Real Estate Board says the benchmark price is a more accurate reflection of the market’s trends.

The benchmark value for a condominium in the region last month increased 9.6 per cent to $579,400, while the benchmark townhome price jumped 9.1 per cent to $798,400 year over year.

“November saw a significant decrease from last year in the number of home sales recorded, but this was expected as the market continues to settle after the record-setting pace of 2021,” said Victoria Real Estate Board president Karen Dinnie-Smyth. “With a small month over month decrease in price, the autumn market has returned to its traditional rhythm as we approach the holiday season.

“Inventory levels dipped slightly but remain well above this time last year, which is providing buyers with more options.”

There were 2,111 active listings at the end of November, a 138 per cent increase from the 887 active listings at the end of November 2021.

Dinnie-Smyth said it’s unclear what effect the province’s plans to change the Strata Property Act will have on the marketplace. The province wants to remove rental restrictions and some age restrictions. The age-restriction proposal would not affect strata developments for people ages 55 and older.

“It is an open question whether these changes will bring any additional rental stock to the market,” she said, noting given the complexities of the Residential Tenancy Act not all homeowners of vacant strata homes want to become landlords, while rising interest rates have made investing in strata rental properties less attractive.

“It is also possible that these measures will contribute further to eroding housing affordability as older stratas with rental restrictions were generally valued lower than their rentable counterparts,” she said.

>>> To comment on this article, write a letter to the editor: [email protected]