Some real estate agents are seeing prices starting to drop, with more listings in Greater Victoria’s real estate market and fewer sales.

Daniel Clover, a real estate agent with Re/Max Camosun, said Monday that he’s hearing from other agents who are dropping prices on some properties, including a recent case where a condominium’s price was reduced by $30,000 before it finally sold.

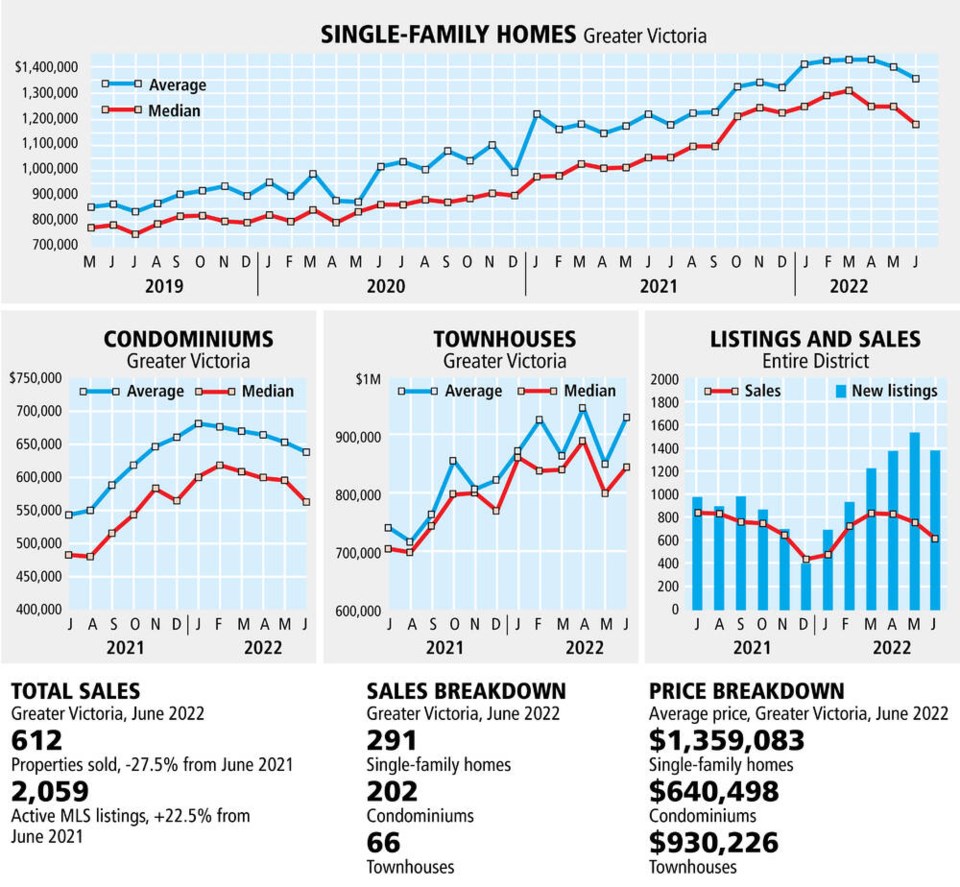

The number of active listings climbed to 2,059 at the end of June, up from 1,776 last month and 1,375 in June 2021.

At the same time, sales through the Victoria Real Estate Board declined to 612 last month from 761 in May and 942 in June of last year, the board said in its latest monthly report.

But Greater Victoria remains a popular destination and bidding wars are continuing for entry-level properties, Clover said.

The change in the market is due to a combination of factors, including rising interest rates and buyer fatigue, said Clover, who has been in the business 37 years and has had buyers cry on his shoulder in disappointment at losing out on a home.

The market peaked in 2017-2018, then climbed again part-way through the pandemic before starting to decline again in recent months. Normally, there is a longer break between spikes, Clover said.

Some sellers are now questioning why they didn’t list three months earlier, when the market was red-hot.

While bidding wars and non-condition offers were common when the market was hotter, buyers are now coming in with more conditions, he said.

Buyers may be watching prices dropping, but rising interest rates will also affect their bottom line.

The benchmark price for a single family house in the core — Victoria, Saanich, Oak Bay, Esquimalt and View Royal — remained high at $1.464 million last month, up from $1.184 million in June of last year.

Meanwhile, the benchmark price for a condominium in the Greater Victoria region was $630,100 in June, versus $491,900 in June 2021.

With inventory growing, approaching pre-pandemic numbers, Victoria Real Estate Board president Karen Dinnie-Smyth said the market feels a “little more normal now.”

Yet with prices remaining out of reach for many, who worry they may never be able to own their home, Dinnie-Smyth called on all levels of government to “aggressively address” housing supply.

“We need more supply of all types of housing,” she said, adding changing interest rates, supply-chain issues and labour shortages will all hamper the ability to provide enough new homes to meet growth projections.

“New supply will be the key to future housing attainability in our community.”

Sales of single family homes dropped to 302 through the board’s multiple listing service last month, down from 440 in June a year ago.

Condominium sales slid to 202 in June from 338 the same month in 2021.

>>> To comment on this article, write a letter to the editor: [email protected]