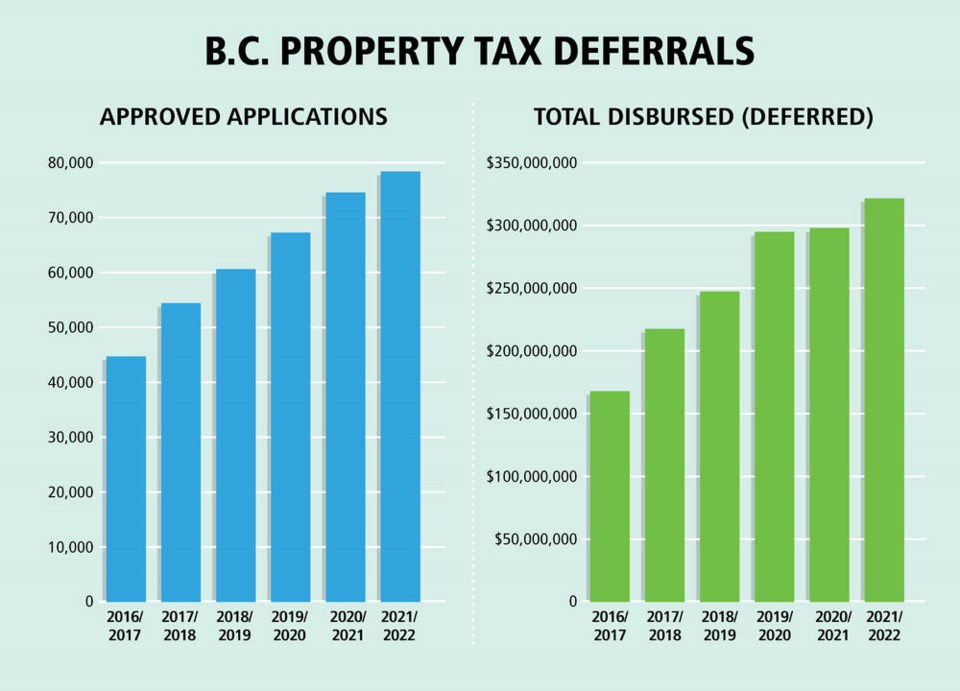

The provincial government anticipates covering as much as $350 million in property-tax payments for B.C residents in the coming year, as demand for tax deferrals is once again expected to rise.

With increases in the cost of living, household budgets being stretched and more people now qualifying for the tax-deferral program, the province anticipates in the coming year it will provide as much as $20 million more than the $322 million it has spent so far on 78,418 B.C. households in the 2021-22 fiscal year, which will end March 31.

The Ministry of Finance says use of the tax-deferral program has grown steadily as more baby boomers qualify for it.

Property-tax deferral, which has been around since 1974, is a low-interest loan available for people aged 55 or older, people with disabilities, surviving spouses of any age and families supporting children.

The loan is available for tax payable on a principal residence in which the resident has at least 25 per cent of the home’s assessed value in equity. The loans do not have to be re-paid until the resident sells the home, or the estate of a resident intends to change title on it.

In a statement, the Finance Ministry said the program has grown every year to where it now has $1.8 billion in deferred taxes owing. “While new deferrals are added each year, other taxes are paid as homes are sold,” said the ministry, which expects growth of $20 million a year.

“While it is noticeable in the past few years, the growth has been steady, and has increased in value in the past few years, as have property values.”

Sophie Salcito, a financial adviser with Vancity, said the increase in deferrals comes as the cost of housing goes up and people require bigger mortgages and face rising expenses. “If people are older and able to now defer the property tax, it is a way to save thousands of dollars a year and they can apply that to other expenses,” she said, noting the cost of deferring is low, given the interest rate charged by the province is currently 0.45 per cent for older residents and 2.45 per cent for families with children.

The interest rate, which is likely to change April 1, is based on prime minus two per cent for the regular deferral program, and is set at prime for families with children.

“The interest you pay is simple interest [only on the principal], not compounded, and you can imagine if you could take that few thousand dollars and pay down your Visa. It may be that [deferral] is a smart financial decision for you.”

Salcito said clients regularly ask about the program, though it tends to be older B.C. residents concerned about inflation and looking for a way to save a few thousand dollars to cover expenses.

The 78,418 homeowners who applied for 2021-2022 represent a significant increase from the 54,431 who applied five years ago to cover $217 million in taxes. For 2020-2021, it was 74,580 getting loans worth $298 million.

Stephen Whipp, principal at Stephen Whipp Financial, said deferral is a regular topic of conversation with his older clients.

He said while some are uninterested in taking on debt even at low interest rates, or don’t want to leave debts tied to their homes for the next generation, others view it as a practical way of easing the monthly budget.

“It really depends on the individual,” he said, noting many see having a few hundred extra dollars every month as an appealing prospect.

Whipp said given rising property values in places like Victoria, it’s a reasonable consideration for some to have the province cover the taxes and have the estate pay off the debt after death.

“There’s pros and cons to everything,” Salcito said. “You can’t get a reverse mortgage without paying out any property tax owing and you can’t change title on a property, so there’s a few things that clients have to think about.”

Scott Travelbea, mortgage specialist at Dominion Lending Centres Travelbea & Associates, also pointed out that the deferral becomes a second charge on the property and until it’s paid off, the homeowner can’t move the mortgage from one lender to another.

That can mean a homeowner’s bargaining power is significantly diminished and they could face paying higher mortgage rates.

“When you can’t move your mortgage from one lender to another, from a standpoint of competition when your mortgage comes up for renewal you may be in a position where you’re subject to paying more than what you want,” he said.