Most property owners in Greater Victoria will see minor drops when 2024 property assessment notices start turning up in mailboxes this week, as the high-interest-rate environment slows the real estate market.

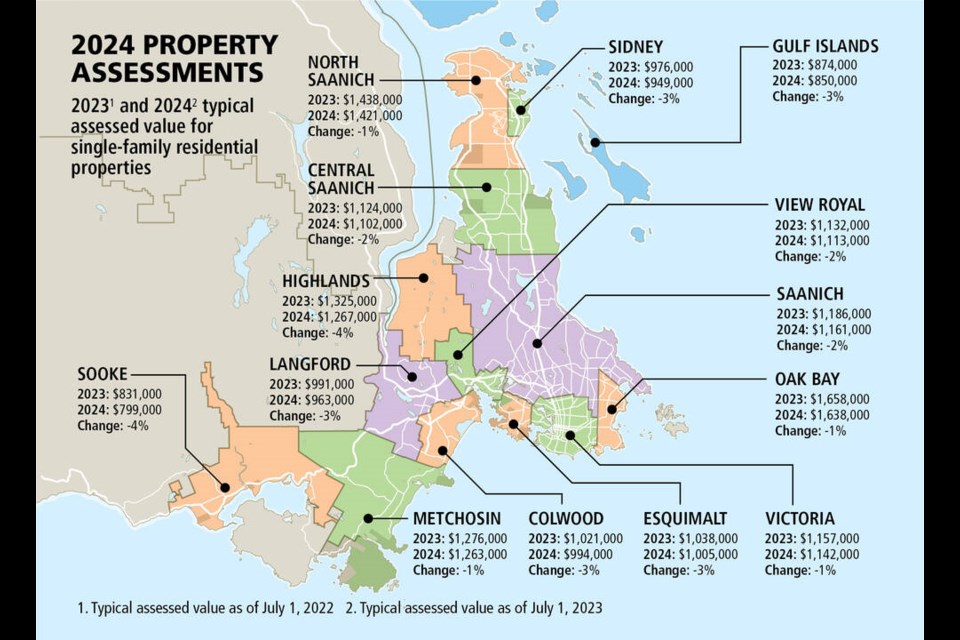

Homeowners can expect to see assessments that are one to four per cent lower than last year’s. For Greater Victoria, the biggest decrease in assessed value for a typical single-family home was in Sooke and Highlands.

Both saw values drop by four per cent to $799,000 and $1.27 million respectively.

The average drop in the typical evaluation for Victoria, Oak Bay, North Saanich and Metchosin, meanwhile, was one per cent.

The typical assessed value of a single-family home in Victoria fell to $1.14 million.

Matthew Butterfield, B.C. Assessment’s deputy assessor for Vancouver Island, said the generally flat values — a mix of small decreases and modest increases — reflect the softening real estate market, which was, in turn, affected by rising interest rates.

The assessment is the estimate of a property’s market value as of July 1 and physical condition as of Oct. 31. Assessors take into account current sales in an area, as well as the size, age, quality, condition, view and location of a property.

Changes to assessed values for strata properties ranged from decreases of one per cent in Saanich, View Royal and Oak Bay to increases of six per cent in Colwood, where a typical strata unit’s assessed value jumped to $650,000 from $615,000.

Butterfield said the increase in Colwood might have been influenced by the number of new projects, which tend to fetch higher prices.

“But for the rest of the Greater Victoria area it’s pretty flat,” he said.

The Central Island region saw assessed values decline, with typical values dropping one to nine per cent from last year.

The value of a typical home in Lake Cowichan fell nine per cent to $587,000, while Port Alberni and Tofino saw decreases of one per cent to $499,000 and $1.6 million respectively.

The year-over-year change in the North Island varied widely, with owners of a typical home in Port Alice facing a 34 per cent increase in assessed value to $349,000 and those in Zeballos facing a 29 per cent increase to $140,000, while owners of a typical Sayward home will see a 10 per cent decrease to $350,000.

Butterfield said those numbers reflect the markets. “If there’s a steady demand and limited supply, you’ll see that reflected in the values people are willing to pay,” he said, adding an increase or decrease of five per cent was more typical for Island homeowners.

The Island’s total assessment value increased to $386 billion from about $385 billion last year. About $4.86 billion of that is from new construction, subdivisions and the rezoning of properties.

Last year, with average property values in the province increasing by 12 per cent, the province boosted the homeowner grant threshold to $2.125 million. This year, it moved up again to $2.15 million.

Grant amounts will remain the same as last year — homeowners whose properties are assessed at or below that threshold qualify for up to $570 for the basic homeowner grant, and as much as $845 for those age 65 or older.

Butterfield said changes in assessed value do not necessarily mean higher property taxes, since taxes are affected only by how the assessment changes relative to the average change in that community — a higher-than-average increase might bring higher taxes.

Anyone who thinks their property assessment does not reflect market value as of July 1, or who sees incorrect information on their notice, is advised to contact B.C. Assessment. If they are not satisfied after that, they can submit an appeal.

“We would like to encourage people to give us a call, especially in January. We’re happy to work through and explain any changes to the property assessment with members of the public,” he said.

Property assessment review panels, which are independent of B.C. Assessment, are appointed annually by the province and meet between February and March 15 to hear complaints.

The deadline to file an appeal of an assessment is Jan. 31.

B.C. Assessment said more than 98 per cent of property owners accept their property assessments without a review.

The residential property in the capital region with the highest assessment this year was once again James Island, at $57.93 million, down from $61.24 million last year, although it held onto its third-place ranking in the province.

At the top of the provincial list is the $81.76-million Point Grey mansion of Lululemon founder Chip Wilson, which jumped in value from its $74-million valuation last year.

The most valuable single-family home in the capital region this year is 1850 Lands End Rd., which was assessed at $17.5 million, surpassing 3160 Humber Rd. in Oak Bay, which this year was assessed at $16.24 million, down from a $16.8-million valuation last year.

The total value of real estate on the provincial roll is about $2.79 trillion, an increase of three per cent from 2023.

New construction, rezonings and subdivisions accounted for $39.62 billion, an increase of just over 18 per cent from the 2023 roll.

There were about 2.18 million properties on the 2024 roll, an increase of about one per cent from last year.