Nearly 18 months after the Cullen commission made two key recommendations, one to create a special investigation unit and the other to create an independent commissioner, neither has been implemented.

Austin Cullen, a B.C. Supreme Court Justice who headed the three-year inquiry, recommended creating a new money laundering intelligence and investigation unit because the federal government was failing to carry out its mandate to investigate money laundering. A 2019 B.C. government-commissioned report on money laundering in real estate in B.C. made a similar recommendation.

The second key recommendation from Cullen was to create an independent office of the B.C. legislature for an anti-money-laundering commissioner to track implementation of the more than 100 recommendations and results of changes. The office would report out publicly each year and could also provide advice. Cullen recommended the anti-money-laundering commissioner because he was concerned that complex, cross-government efforts would stall over time without permanent oversight.

In a written response to Postmedia News’ questions, B.C. Finance Minister Katrine Conroy didn’t answer whether the two key recommendations will be implemented.

The ministry also didn’t answer questions on other specific recommendations from earlier reports, including whether a new independent regulator for gaming, to be called the independent gambling control office, has been fully implemented.

Conroy said an interim report will be released in 2024 on progress of the Cullen commission recommendations. She didn’t provide a specific date.

“Work is currently underway on recommendations from the Cullen Commission Inquiry into money laundering in British Columbia, and we’re working to ensure implementation is as effective as possible,” said Conroy.

Including the proposals from the Cullen commission there have been more than 170 recommendations from B.C. government-commissioned reports dating to 2018 on combating money laundering.

Peter German, a former deputy commissioner of the RCMP, delivered two reports for the B.C. government, a first on money laundering in casinos and a second on other areas including in real estate and luxury vehicle sales. Another report, led by Simon Fraser University professor Maureen Maloney, was delivered on how to combat money laundering in real estate.

In her written response, Conroy said recommendations in the first German report on casinos are complete and the province has completed recommendations or work is well underway on recommendations in the other two reports.

Progress has included tightened oversight in gaming, a beneficial property ownership registry, creation of B.C.’s Financial Service Authority that regulates mortgage brokers and real estate professionals, unexplained wealth orders and new provincial oversight of currency exchanges.

Ron Usher, general counsel for the Society of Notaries Public of B.C., said there has been some good progress, including the filing last week by the B.C. government of the first unexplained wealth order in B.C. Supreme Court to compel property owners to explain where $1 million came from to buy a Salt Spring Island house in 2017.

But Usher, who testified at the Cullen commission, said a big challenge is whether the province can push criminal investigations and prosecutions forward, which have in the past required the assistance of the federal government through the RCMP and the country’s financial intelligence gathering agency, the Financial Transactions and Reports Analysis Centre of Canada, more commonly known as Fintrac.

“If police enforcement through the Criminal Code is too hard, then we have to get going on these other things,” he said.

He was referring, for example, to asset forfeiture through civil court action.

Usher said another challenge is better information sharing between agencies that sometimes gets held up by privacy concerns. The legislative authority for information sharing needs to be figured out, said Usher.

Cullen recommended the new policing unit be located within the province’s Combined Forces Special Enforcement Unit, a 400-member anti-gang agency that includes officers from the RCMP and municipal forces.

Cullen made the recommendation to give the province more oversight into the new unit’s operations and greater flexibility to hire and retain officers and civilian specialists who have the knowledge and skills to investigate money laundering.

Sasha Caldera of Publish What You Pay Canada, which advocates for financial transparency, says B.C. has taken significant steps with the implementation of a public land ownership transparency registry in 2021 and a promise to create a corporate transparency registry by 2025.

“That was big,” said Caldera, whose advocacy group was part of a coalition including Transparency International Canada that testified at the Cullen commission.

The public corporate registry was a recommendation of the 2019 report on money laundering in real estate and the Cullen commission.

But Caldera said both registries need to be free to search by the public. Currently, the land ownership registry has a search fee of $5.25.

He added there also needs to be some form of owner identification verification for the registries.

Caldera said he is supportive of a financial crime investigation unit in B.C. but noted there is also an argument to reform and beef up the federal capacity to investigate these types of crimes by the RCMP and through FINTRAC.

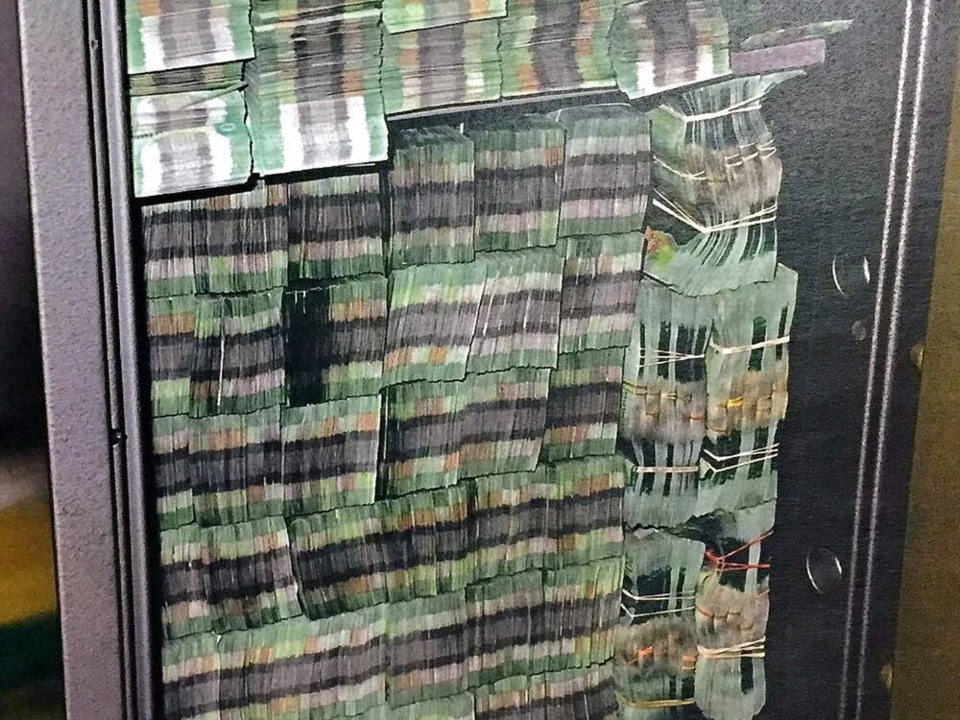

Money laundering has been in the spotlight in B.C. since at least 2017 when several Postmedia investigations found that Lower Mainland casinos were being used to facilitate the practice. Postmedia also found that money-laundering prosecutions were rare and difficult, and that shell companies and nominee directors were used to hide assets.

Another Postmedia probe found at least $43 million in properties were tied to B.C.’s largest money-laundering case, which failed to lead to a successful criminal prosecution. A 2019 Postmedia analysis of 12 money laundering cases dating back nearly three decades, found money is laundered in real estate using a number of mechanisms, often with the help of shell companies, and involving several countries and banks.