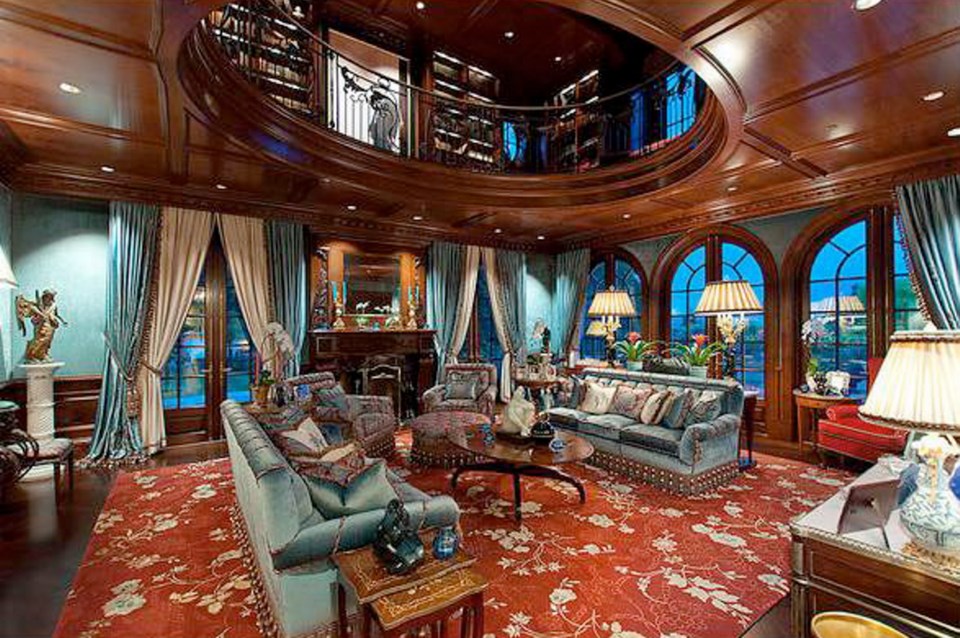

Chinese buyers are snapping up some of the most exclusive real estate in the Lower Mainland. The latest jaw-dropping sale was a $51.8-million mansion on three lots, one of which overlooks the ocean.

The Point Grey home was owned by Don Mattrick, the Vancouver tech entrepreneur, and his wife, Nanon De Gaspé Beaubien-Mattrick, a tech investor and heiress to a Canadian telecom fortune.

Land title documents show the property, which boasts a 10-car garage, sold in mid-December to Mailin Chen, a businessman from mainland China, and his Vancouver-based company, Chunghwa Investment (Canada) Co. Ltd.

Chunghwa Investment was incorporated in March 2010 and has an office on Howe Street in downtown Vancouver. No one answered phone calls there. A Mandarin-speaking assistant at Chen’s personal Yaletown office said he was not available. A phone call to the home at 4787 Drummond Drive, which is now listed under Mailin Chen’s name, was also not answered.

Chen has bought and sold other luxury properties in Metro Vancouver in the past, including selling a $10.5-million Shaughnessy home at 1550 Laurier Ave. in December. According to land title documents, the purchaser of that home was restaurateur Ling Xu.

The Drummond Drive sale, which was not listed and not conducted by real estate agents, is one of the richest in the B.C. housing market. It comes as agents say the market is hopping with interest from buyers with cash from mainland China. These include Canadian citizens, residents and visitors. (Starting in 2012, Chinese nationals could apply for a 10-year, multiple-entry visa, giving them new mobility to travel and buy property here.)

The $51.8-million price for the house on Drummond Drive was almost as much as the most expensive Vancouver home, which is assessed at $57 million and owned by Lululemon founder Chip Wilson.

But there is similar clamouring for prime properties on a smaller scale in other pockets of the local real estate market.

Recently, a house at 1383 West 32nd Avenue in Shaughnessy went into contract for $8.01 million, or $2 million over the asking price of $5.99 million.

In West Vancouver, 118 houses were sold in February, compared to 63 the year before for an increase of 87 per cent. Of homes in the $4 million and higher category, agent Clarence Debelle of Royal Pacific Realty estimates some 75 per cent went to buyers with ties to mainland Chinese money.

The burst of activity is due primarily to wealthy Chinese, some of whom live in Canada but keep or earn money overseas, and others in China who are looking to buy abroad.

They are motivated by conditions such as low interest rates and the Canadian dollar’s decline against the Chinese yuan, which is linked to the U.S. dollar and is up 18 per cent over the past 18 months.

Vancouver Realtor Manyee Lui puts it into a working person’s math: “If you were looking at a house that was $800,000 Cdn. (in yuan terms), now you can look at something for $1 million Canadian.”

Other factors are the weakening economy in China and the entrenched political battle to root out corruption. Escaping the polluted skies of China’s cities has long been on the list of reasons to get out, but, in more recent weeks, this has been heightened by the release on the Chinese Internet of Under The Dome. The film, made by a former Chinese state television reporter, is told from the perspective of parent of a young daughter. It struck an emotional chord while condemning the country’s weak environmental protections.

The phenomenal flow of Chinese money is not only coming to Vancouver, but other desirable real estate markets in the world. This is pushing up property values and leading to increased scrutiny of the provenance of some of the cash leaving China.

Between 2002 to 2011, US$1.08 trillion in capital has left mainland China illegally, according to the most updated report by Global Financial Integrity, a U.S.-based group.

Technically, there is a US$50,000-a-year limit on cash that can be taken out of China, but buyers have long got around this by using friends and relatives to move chunks of money under different names. Some also tack personal cash onto legitimate export and import transactions by using fake invoices.

Canada does not have rules about foreign ownership of real estate and does not track purchases as such.

In Australia, which has also had a rush of Chinese money into prime Sydney properties, overseas buyers are only allowed to purchase newly built properties with permission from the Foreign Investment Review Board. Last week, the government there ordered an Australian company, owned via shell companies by China’s Evergrande Real Estate Group Ltd., to sell an A$39 million ($37.8 million Cdn.) Sydney mansion it had purchased, calling the original purchase illegal.