The B.C. NDP is scrambling to respond to backlash over its surprise announcement that all homeowners in B.C.’s urban centres will be treated like speculators unless they fill out a tax exemption to declare otherwise.

Finance Minister Carole James defended the exemption process, saying it’s as easy as applying for the homeowner grant.

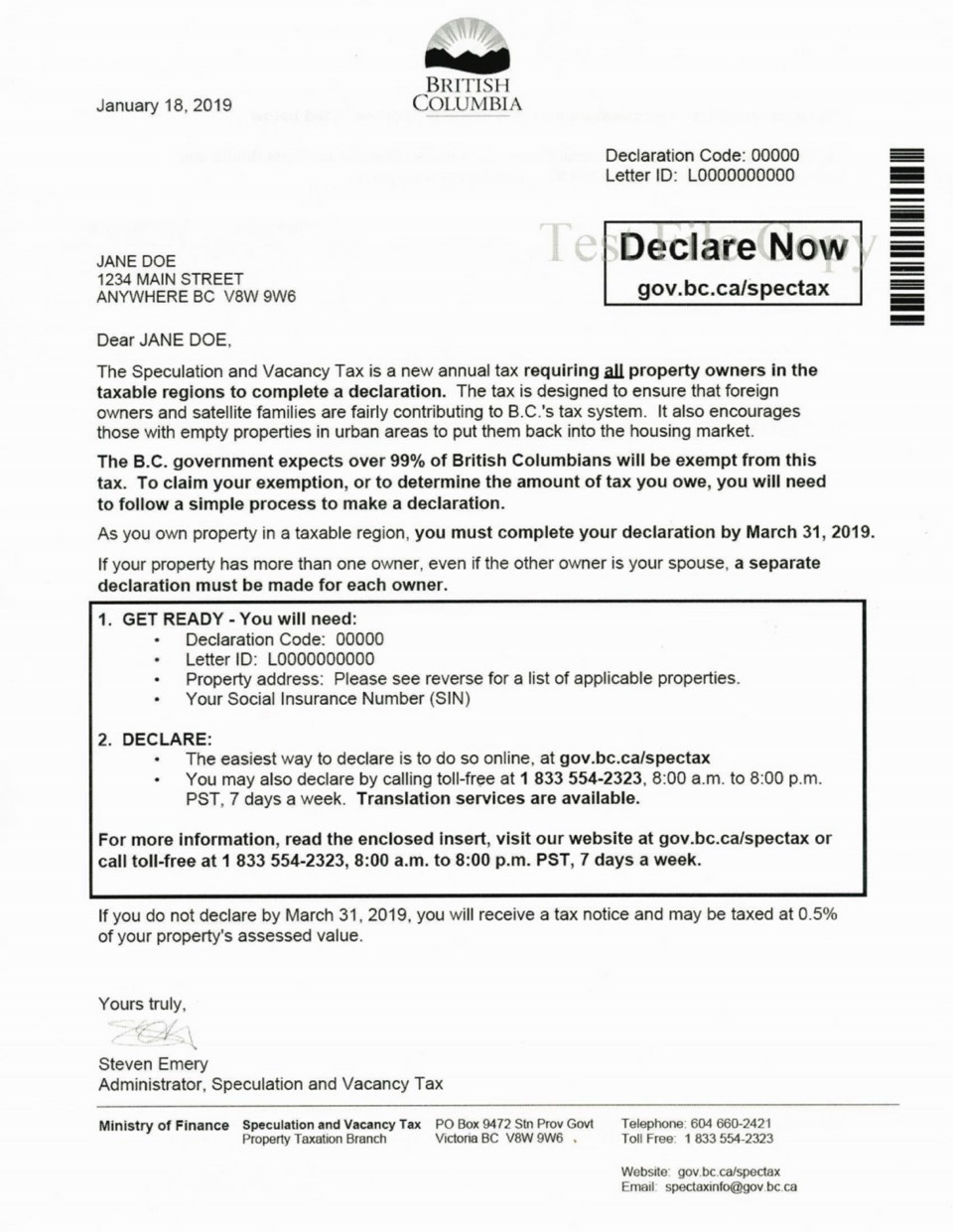

The Ministry of Finance will send letters outlining how to apply for a speculation tax exemption to owners of homes in Greater Victoria, Nanaimo, Kelowna and Metro Vancouver, including Abbotsford, Mission and Chilliwack. The ministry estimates 1.6 million households will receive the letter and about 32,000 homes will be taxed.

Kris Sims, B.C. director of the Canadian Taxpayers Federation, slammed the exemption process, calling it “taxation by default.”

“The idea that somehow you’ll automatically have to pay unless you spent 20 to 40 minutes filling out a form every single year to prove you’re not a speculator … it’s unfair, it’s wrong-headed.”

The B.C. NDP’s campaign promises around taxing foreign homeowners were vague and now the government seems to be making up policy as it goes, Sims said.

“When you’re dealing with someone’s prime investment, something like their private property, and you’re dealing with this amount of money with this amount of people, you can’t just make that stuff up on the fly.”

Langford Mayor Stew Young, who opposes the inclusion of his municipality in the speculation tax area, was livid when he heard about the exemption process.

“I was against it before, now I’m appalled,” Young said. “This is absolutely not the way to treat hardworking taxpayers. It’s not a speculation tax anymore, it’s a tax grab.”

Langford council will pen a letter to the B.C. government, urging it to rethink the exemption process and asking once again that Langford be removed as a speculation tax area.

“I think its absolutely dishonourable for Carole James to tell the public it only affects one per cent, but now 100 per cent of residents in Langford have to fill out the form to prove they’re not speculators,” he said.

In a sample letter provided to the media, homeowners are asked to declare online or by phone by filling in their declaration code, letter ID, property address and social insurance number.

In a demonstration of the online form, ministry staff clicked through about five pages where people are asked to enter information or select from a drop down menu. Staff said the whole process should take about 10 minutes and is similar to the homeowner grant.

Homeowners must apply for an exemption by March 31. Anyone who doesn’t apply and those who don’t qualify for the exemption will receive a tax bill which must be paid by July 2.

Ministry staff said homeowners who forget to apply by March 31 will get a second notice in May and a third in June. A homeowner can still apply for the exemption after receiving the tax bill.

James acknowledged that the onus is on homeowners to file the exemption but said “checks and balances” are in place to make sure people don’t pay unfairly.

“If you are exempt, you do not pay the tax,” James said. “I think it’s important to remember that in order to get almost any government benefit or in order to enroll in a program, you have to fill out the form and you have to give your information.”

Homeowners must opt-out of the tax annually and those who mistakenly pay the tax can get a rebate within six years, the ministry said.

“Six years is an awful long time to be waiting for money that is yours and money that the government has mistakenly, oopsie, taken from you,” Sims said.

Targeted at urban centres, the speculation tax will cover properties not occupied by the owner as a primary residence for more than six months a year or not occupied by a tenant.

Homeowners who fall into this category will have to pay 0.5 per cent of the home’s assessed value in 2018.

In 2019 and subsequent years, it is two per cent for foreigner owners and “satellite families.” It remains at 0.5 per cent for Canadian citizens and for permanent residents who are not members of a satellite family. A satellite family is a household where more than 50 per cent of income comes from outside Canada.

British Columbians with vacant second homes will be eligible for a credit of $2,000 which will cover the tax on the assessed value up to $400,000. The remaining value of the property will be taxed at the full rate.

Exemptions are available for First Nations, local governments, charities, co-ops, some not-for-profit organizations, and developers working on construction or renovation of property.

Condos and apartments in buildings where stratas ban rentals are also exempt, but only for 2018 and 2019, to give stratas time to change their bylaws, according to the ministry.

Despite voting to pass the speculation tax into law, B.C. Green Party Leader Andrew Weaver said he thinks the speculation tax is bad public policy. “I’m not going to defend their tax because it’s not dealing with speculation, it’s a form of vacancy tax,” he said.

The Greens voted to pass the speculation tax into law only after major concessions were made to limit the negative impacts on B.C. homeowners, Weaver said. “We made it better so the unforeseen consequences were severely mitigated,” he said. “We could not mitigate the dogs breakfast of having to go through this [exemption] process.”

The Green Party is in favour of a law that bans foreign residents from owning property, similar to the laws rolled out last year in New Zealand.

Weaver had previously pushed the government to allow municipalities to opt out of the tax, but the NDP would not agree to that.

— With files from the Vancouver Sun