The province’s phased-in approach to restarting the provincial economy seems to have had an effect on the Victoria real estate market.

Figures released Monday by the Victoria Real Estate Board show sales, inventory and some prices rose in conjunction with the second phase of the provincial restart plan.

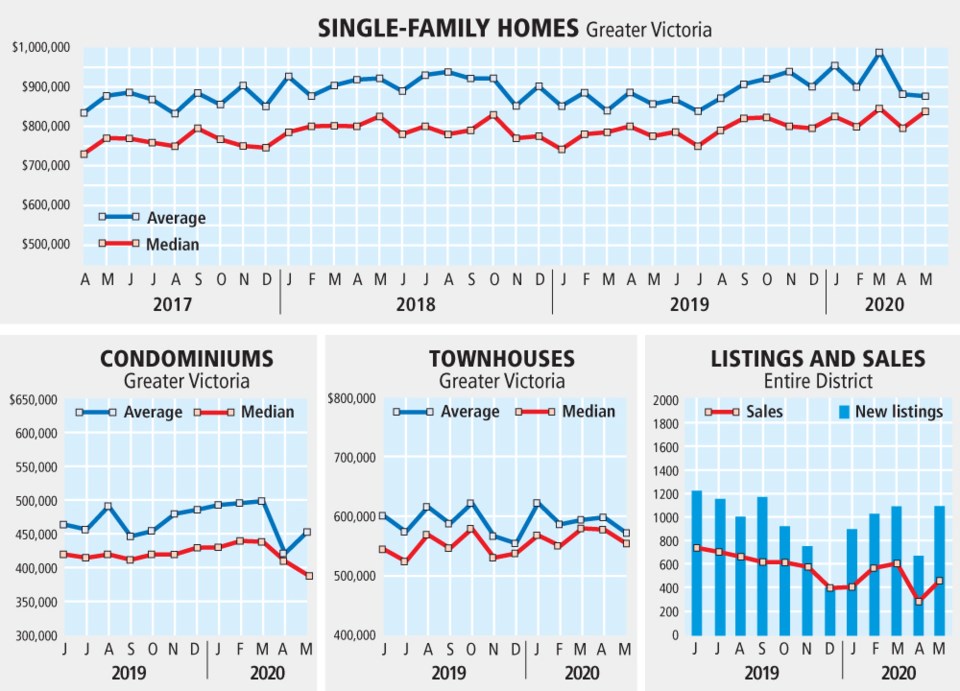

Last month, 457 properties changed hands in the region, and while that’s a 46 per cent drop from May of last year, it’s a big jump from the 287 homes sold in April.

“We are still down in terms of sales [year-over-year], but we were up from April, and we saw a real uptick after May 19, when Phase 2 was implemented,” said Sandi-Jo Ayers, president of the board. “We are feeling cautiously optimistic based on the numbers from last month. And our home prices have seen a slight increase from last month as well.”

There were 2,544 active listings for sale at the end of May, up from the 2,305 available at the end of April. That is still well off the more than 3,000 available in May last year.

The benchmark price of a single-family home in the Victoria core last month was $885,400, up from $884,600 in April. Year-over-year, the price was up from $863,000. The benchmark condominium price in the core last month was $534,300, up from $533,600 in April, and $516,400 in May 2019.

“I’d say we have seen a trickle of activity, not a tsunami. People are being cautious,” said Ayers, who noted buyers want to ensure they are employed and that they can qualify for the kinds of homes they want.

Indications are Victoria’s real estate market could avoid some of the pain other markets in Canada will face this year, she said. “We believe the way B.C., the Island and the community have responded to the health crisis and our market being local, [real estate] has responded in a healthy way as well here,” she said. “Victoria is such an attractive place to live, it’s safe and the way we responded to this health crisis is catching people’s eye and they may start to think this is a good place to retire or move.

“We firmly believe we are on the radar now.”

The short-term outlook is likely to remain cautious, but Ayers said they expect to see a lot of local movement ahead of the fall school opening, and with local buyers moving up and down in the market.