“Speculators” were always going to hate the speculation tax, that’s pretty much a given.

“Speculators” were always going to hate the speculation tax, that’s pretty much a given.

What the provincial government has managed to do this week is annoy a good part of the vast majority of homeowners who would never be considered speculators.

As soon as a government starts playing the targeted tax game, it can count on a certain amount of “better them than me” passive support from those who aren’t targets.

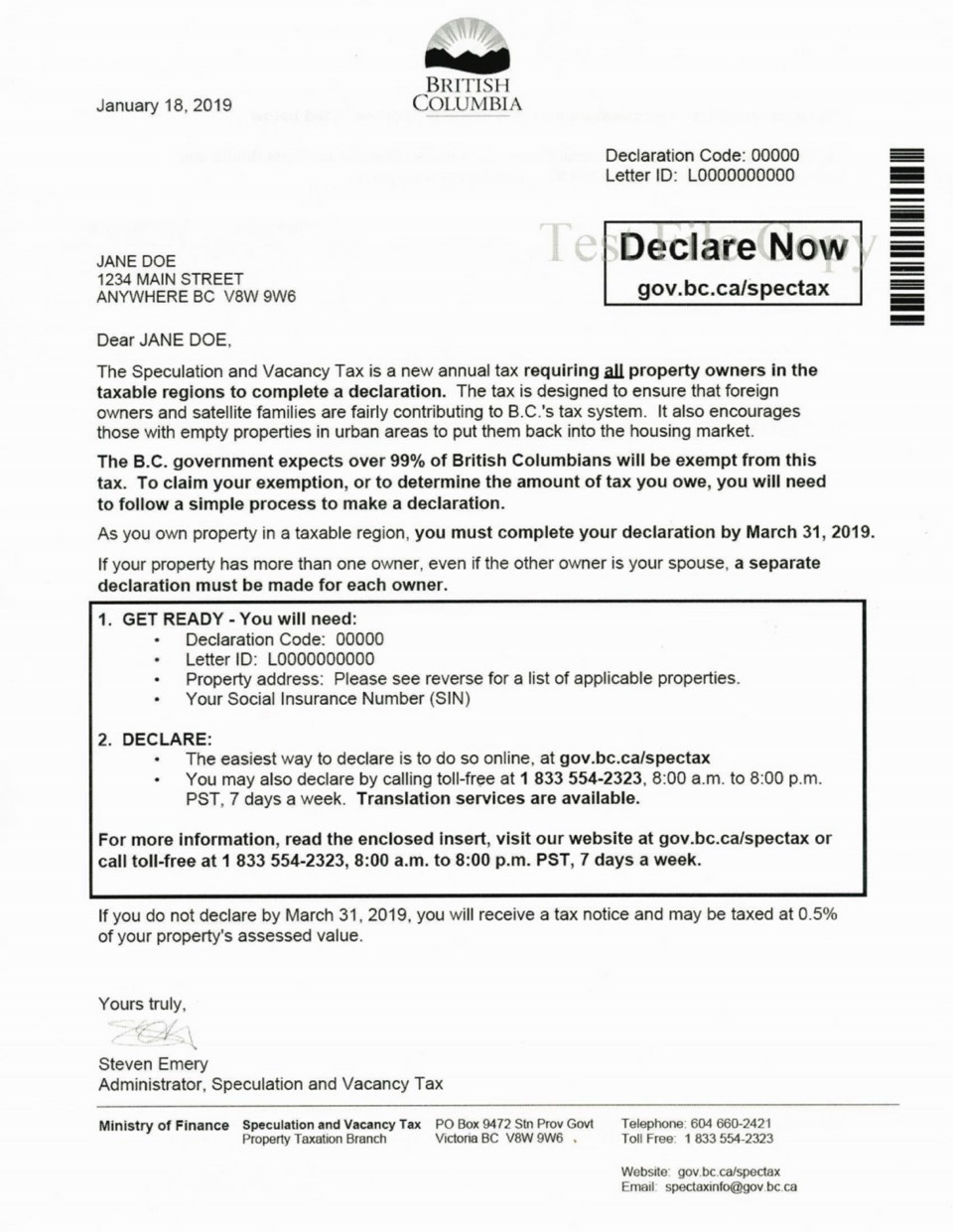

That eroded somewhat this week, when the mechanics of collecting the levy were announced. The collection system presumes that everyone has to pay the tax. So everyone has to pursue an exemption to escape it.

As defined by the NDP government, the speculator label applies with certain exceptions to anyone who owns a home that is left vacant for all or most of a year.

They’re going to pay an additional annual tax of several thousand dollars on those homes, so the opposition from that camp was always assured. It was encouraged to some extent by real estate agents who naturally resent any government intrusion in the market aimed at curbing it.

There’s also a streak of philosophical opposition running in a segment of the population. The original framing of the tax portrayed it as aimed at foreigners. That brought objections from people concerned about how unfriendly it is to offshore investors, with particular historical emphasis on Chinese owners. There were also worries about how unneighbourly it is to fellow Canadians.

(The rate was later adjusted so that all Canadians are being dinged equally.)

Politically, a good chunk of B.C. Liberal voters oppose it, simply because it’s a new NDP tax.

But all that opposition was offset to some extent by a broad swath of people who were priced out of the housing market years ago, can never catch up to get in the game and actively resent those who “got lucky.”

Those whose circumstances allow them the luxury of owning a second home (it’s now officially a luxury) they can afford to keep vacant don’t exactly engender a wave of public sympathy for the plight they now find themselves in.

The plus side of the tax is the tens of millions in new revenue it will bring in. Thousands of families have bought into NDP promises to get real about the affordability crisis. They are counting on that to make a real difference in changing the punitive housing equation.

So the NDP was on reasonably safe ground when it started targeting speculators, knowing that 99 per cent of B.C. didn’t fit the label.

That ground isn’t as safe this week, after the realization dawned that the bounty on speculators is initially being put on all homeowners’ heads.

It’s easy enough to escape, if you don’t mind spending 20 minutes or so on an online form every year.

But the scale of the collection effort is annoying even the many people who will avoid it with ease. The government is mailing out 1.6 million notices to homeowners in order to winnow out about 32,000 who fit the speculator label.

The Finance Ministry is drift-net fishing for a relatively tiny school of one species. It’s odd that in 2019, with all the data and information-processing capabilities, a government has to blanket the applicable zones with tax notices.

You’d think the homeowner grant application that people routinely fill out on their property tax notices to certify residency would screen the majority of people. But apparently, that doesn’t identify vacancy. They had to take the most expensive, troublesome route possible to isolate and identify the speculators.

So now the fans of basic efficiency in government are aggrieved. Even if they don’t have to pay the tax, they’ll pay for the big complicated collection effort.

Just So You Know: Readers are invited on Jan. 27 to join me at a tree planted by Sir Winston Churchill in Beacon Hill Park to honour the anniversary of his death in 1965.

A loyal band of Churchillians will be on hand at 2 p.m. on that date next weekend around the tree planted in 1929 near the foot of Quadra Street. There will be a free raffle of Churchill memorabilia, books, stirring speeches and an appearance by the great man himself.