The total sales value of properties sold in one month through the Victoria Real Estate Board has leaped past the $1-billion mark for the first time.

March’s 1,173 sales — including residential properties, lots and acreages, and commercial properties — totalled $1.037 billion in value, the board said in its monthly report, released Thursday.

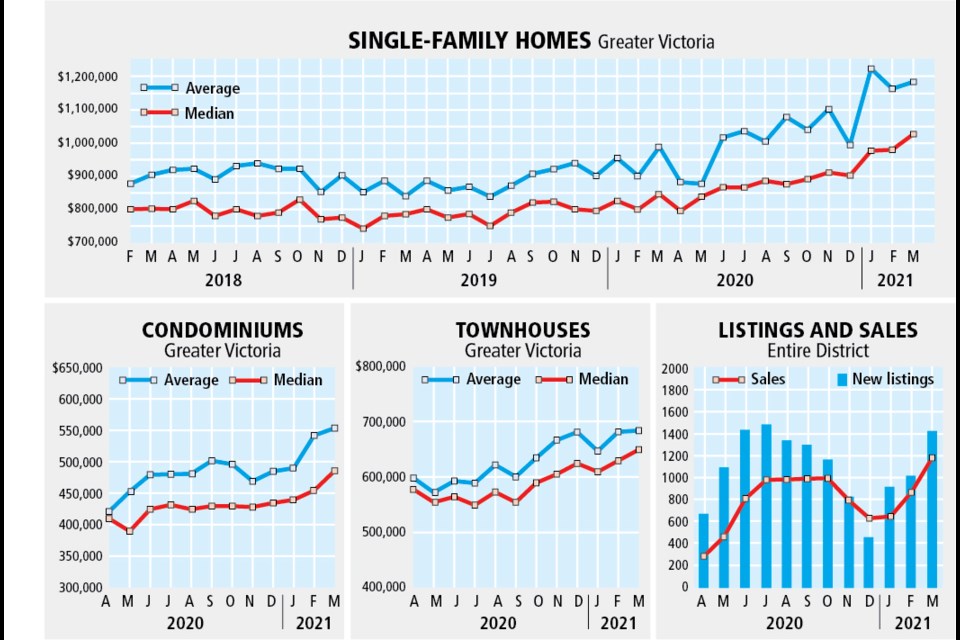

The previous record for total monthly sales was set last year in September at $826.3 million.

Sales in March 2020 totalled $447.6 million, just above the March 2019 sales total of $416.5 million.

In February, the total sales value was $730 million.

Greater Victoria’s intense real estate market, with its robust demand, is attributed to factors such as tight inventory, tough bidding competition and low interest rates.

Local social media sites frequently feature people seeking homes who can’t find anything in their price range or who have been outbid.

The number of sales in March was up 93 per cent from the same month last year, the board said. The average March had 715 sales through the 10 years prior to 2020.

“Numbers from last month are close to the market trends we saw in 2016, but with an even greater imbalance in inventory due to a surge in consumer demand for homes in the Victoria area,” the board said.

The first quarter of 2021 has seen limited supply and overwhelming demand, said Victoria Real Estate Board president David Langlois.

The result has been rising prices in many cases.

The benchmark value for a single-family home in the Victoria core in March 2020 was $879,600. That rose to $968,700 in March 2021, up by 2.2 per cent from the previous month, the board said.

Benchmarks measure the value of a home in a particular area over time, a method the real estate industry considers more reflective of the market than average prices.

The average value for a single-family home in Greater Victoria was $1.18 million last month and the median — the value in the middle — was $1.02 million.

Condominiums saw a slight drop year-over-year with a benchmark value in the capital region of $529,100, compared to $531,800 in 2020. The average in the region in March was $554,137.

A critical factor in housing prices is the number of properties on the market.

At the end of March, there were 1,310 listings through the board’s multiple listing service. That’s down by 41.8 per cent from March of last year.

“The underlying issue is a deficit in supply,” Langlois said.

“Supply needs to be addressed by all levels of government and particularly by local governments, which control land-use policies and development processes.”