A lack of housing inventory, which has been a problem for Greater Victoria for years, will continue to shape the real estate market through 2021 according to the departing president of the Victoria Real Estate Board.

In delivering her year-end summary of 2020 on Monday, Sandi-Jo Ayers noted the lack of available homes could continue to drive prices up as the region’s economy starts to recover from the economic disaster dished out by the COVID-19 pandemic.

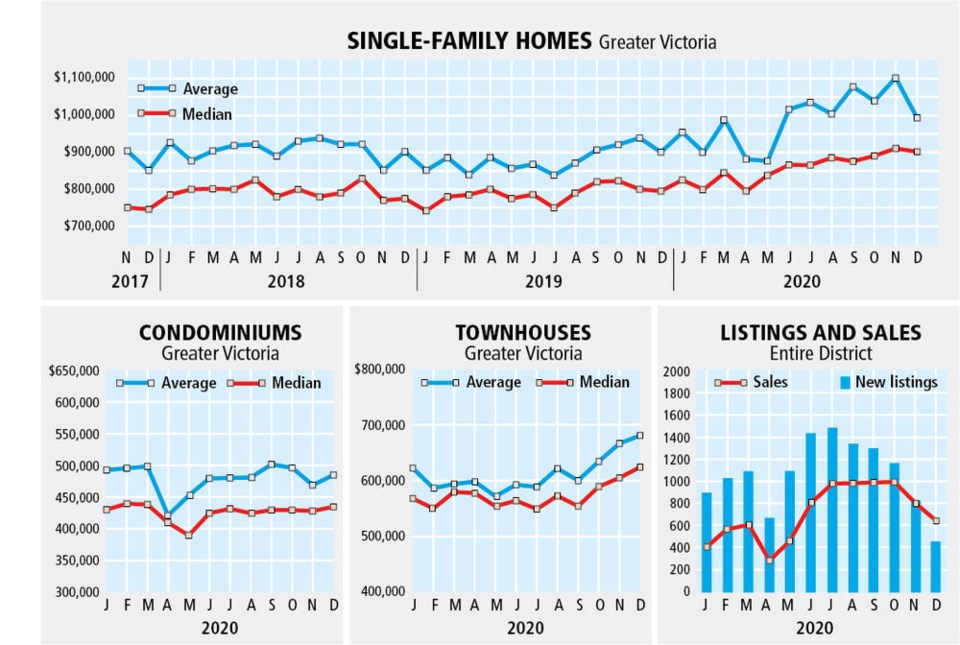

“Inventory continues to be the story. We just don’t have enough,” said Ayers, noting the board recorded 1,279 homes available on its listing service at the end of December, the smallest year-end number in 25 years.

That lack of supply coupled with low interest rates and sustained, strong demand in the region led to brisk sales in 2020 and some home prices soaring.

The region saw 8,497 properties change hands in 2020, eclipsing the 7,255 that sold in 2019 and the 10-year average of 7,329 annual property sales.

There were 631 sales recorded in December alone, up from 402 at the same time in 2019.

Ayers said other than a slowdown in March and April, the real estate market was strong through the entire year.

“Typically, we would see a slowdown around Dec. 15 or so and see it start to pick up again in the first week or so of January, but that just didn’t happen,” she said.

“The onset of the COVID-19 pandemic in March and April quickly swept away any illusions that our normal seasonal market patterns would persist. Equally surprising was the resurgence of our market in early summer when restrictions lightened and pent-up demand began pushing sales beyond expectations,” said Ayers. “The combination of the ongoing pandemic, historically low interest rates and a shift in consumer priorities towards properties that cater to a more home-based work/life/retirement balance resulted in record setting sales for the last several months of 2020.”

Pricing reflected the resilience. The benchmark value for a single-family home in the Victoria core (Victoria, Saanich, Oak Bay, Esquimalt, View Royal) was $915,100 in December, a significant jump from $857,200 in December 2019. The benchmark sale price of a condominium in the core on the other hand dropped slightly to $515,600 last month from $520,100 in December 2019.

Ayers noted even in areas that have traditionally offered more affordable housing like the West Shore there has been sustained price pressure.

The benchmark price of a single-family West Shore home last month was $728,900, up from $643,700 at the same time in 2019.

Ayers said the board has pushed municipalities to reduce red tape and streamline the development process to encourage more building to deal with demand, but she concedes it will take years before the industry catches up.

“The pandemic did not help inventory levels,” she said, noting many people may have been unwilling to put their homes on the market realizing they may not be guaranteed a place to move to. “We’re hopeful vaccines will make a difference there and that some new projects will be coming online soon.”