There are not many ways for one to make a guaranteed 20 per cent return on your money. In fact, if someone told you this, you would likely think it is a scam. However, this could be possible when you make contributions to a Registered Education Savings Plan (RESP).

The government provides the Canada Education Savings Grant (CESG) for contributions made up until the end of the calendar year in which a child turns 17. The basic CESG provides a grant of 20 per cent, up to an annual maximum of $500 per child, up to the lifetime maximum grant of $7,200 per child.

Whenever a client opens an RESP account with us, we map out a detailed contribution schedule for them to ensure they obtain the full $7,200 Canada Education Savings Grant (CESG). We also make sure every client with children/grandchildren is aware of this government program.

Contribution strategy

Every year is important when it comes to contributing to an RESP. The optimal strategy we map out for young parents is to contribute $2,500 each year for the first 14 years of their child’s life and $1,000 when your child is 15. Making the contributions early each year allows a greater amount of time for the value of the RESP to grow.

If coming up with $2,500 as a lump sum is difficult, then we suggest setting up a Pre-Authorized Contribution (PAC) of $208.33 every month (assuming only one child). Automating this with your Portfolio Manager will help to ensure you keep up with your financial plan.

Scenario to obtain full CESG

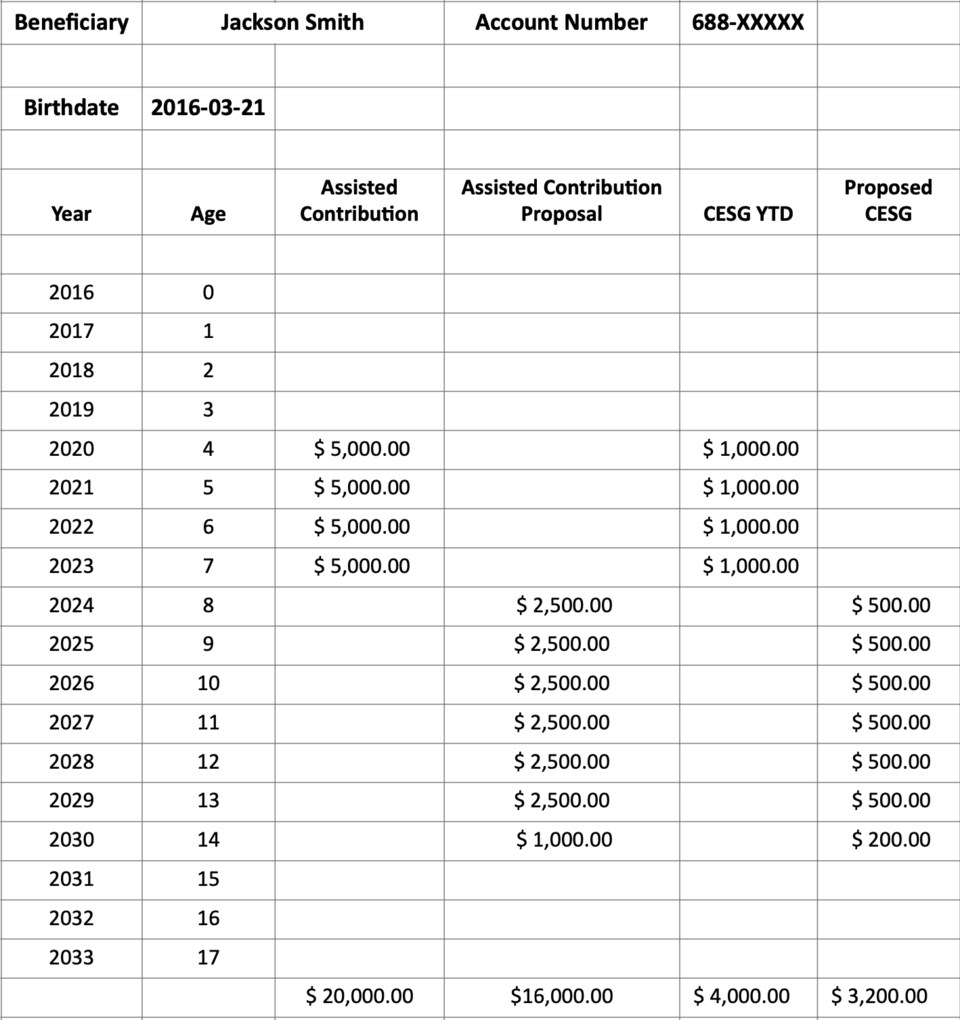

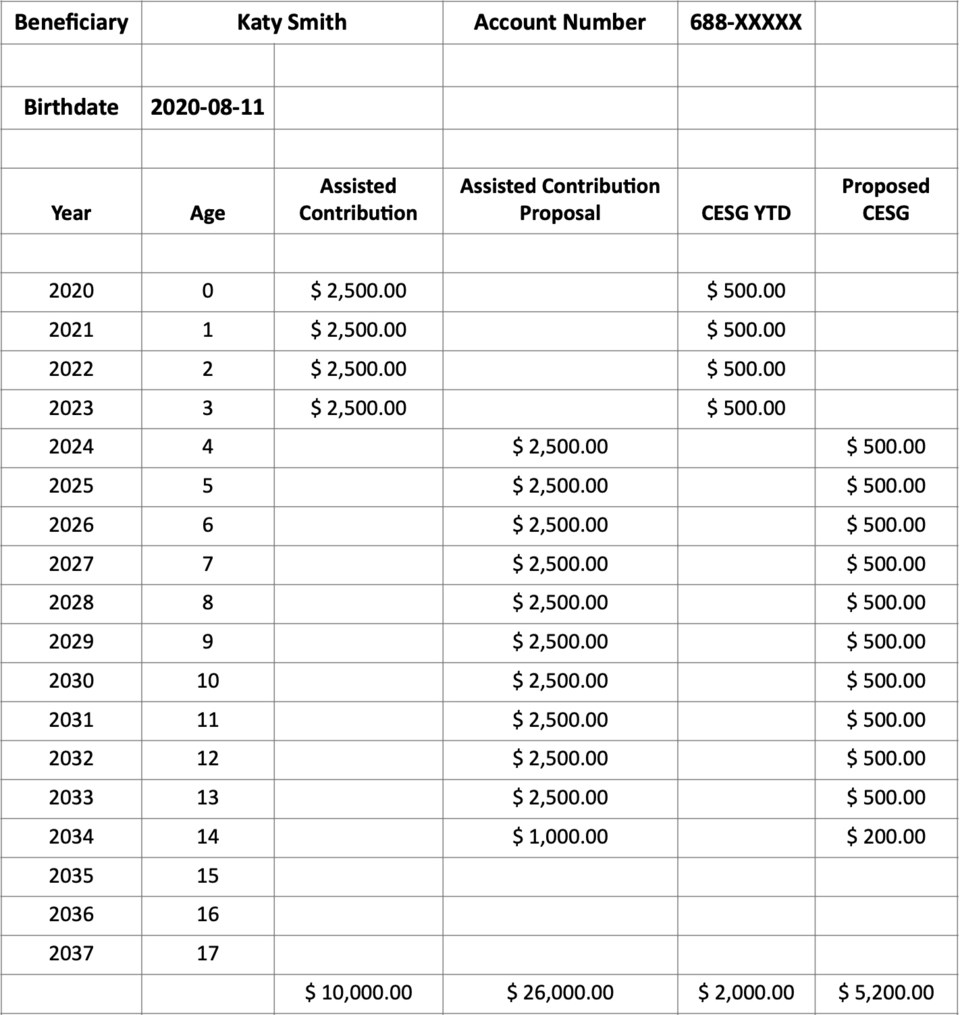

To illustrate, we have used John and Jennifer Smith, who have two children — Jackson and Katy. When Jackson was born, John and Jennifer did not have the cash flow to enable them to fund an RESP. By 2020, John and Jennifer’s cash flow was at a point where they can begin funding an RESP.

We discussed that they are able to contribute up to $5,000 per child a year to claim the CESG for the previous years that they missed contributing to the RESP. We mapped out a plan that enabled them to catch up with the CESG within four years.

The Greenard Group RESP contribution schedule

For every client that has an RESP with us, we prepare a summary of the contributions already made (Assisted Contributions), our proposed contributions (Contribution Proposal), Canada Education Savings Grants (CESG) already received, and proposed Canada Education Savings Grants (CESG) if the proposed contributions are made.

The Smith family has two beneficiaries within one family plan, and we mapped out the following schedule for them:

Beginning in 2020, The above schedule has the Smith family contributing in a way that maximizes the Canada Education Savings Grant (CESG). We encouraged contributions in January every year. The sooner the contribution is done, the sooner they will receive the CESG.

Early contributions and deferral

If a parent or grandparent (the “subscriber”) opens an RESP when a child (the “beneficiary”) is born, and that same child begins their first year of university at age 18, then the funds will have the ability for compounding growth for 18 to 22 years. The maximum deferral of an RESP is 35 years, at which time the plan must be collapsed. The range, therefore, is between 18 to 35 years for those that contribute early on.

Investment options

Now that we have mapped out the strategy of contributions, the next decision is to decide how to invest the money. The RESP account will have your contributions and the CESG all in one account. These funds can be invested in a number of different ways depending on the financial institution you are dealing with.

If you open the account up at a bank or credit union, then your investment options are likely limited to GIC’s or mutual funds. If you open the account up at a full-service investment firm, then you could explore different, lower-cost options outside of mutual funds, especially once the account gets built up.

Investing in individual common shares can be another good option. We feel that the RESP creates a fantastic opportunity to teach children about finances and investing. Every year, you can sit down with your kids and discuss what to do with the current contribution money. You can analyze companies and weigh the pros and cons of different investment choices. Over time, you can teach your kids how they can track their RESP investments.

Savings is key

When it comes to RESP accounts, savings are the key component. As noted above, we recommend annual contributions of $2,500 for 14 years ($500 CESG each year x 14 = $7,000) and a $1,000 contribution in the 15th year ($200 CESG). This contribution schedule enables the subscriber to claim and obtain the maximum $7,200 CESP from the government per beneficiary.

Kevin Greenard CPA CA FMA CFP CIM is a Senior Wealth Advisor and Portfolio Manager, Wealth Management with The Greenard Group at Scotia Wealth Management in Victoria. His column appears every week at timescolonist.com. Call 250-389-2138, email [email protected], or visit greenardgroup.com.