VANCOUVER — A Metchosin man says he’d like a judicial review of the privacy commissioner’s ruling on the collection of personal information for B.C.’s speculation tax.

“They’re asking a great majority of the population to serve as crowdsourcing for data for political purposes,” said Mark Atherton, who made a submission to B.C.’s privacy commissioner on the issue. “I don’t like it.”

B.C.’s Office of the Information and Privacy Commissioner last week ruled that the Ministry of Finance can collect, use and disclose taxpayers’ personal information under the Speculation and Vacancy Tax Act.

The tax is a major component of the government’s $6.5-billion plan to deliver 114,000 affordable homes over the next 10 years. The government said the speculation tax will target foreign and domestic real estate speculators, increase the amount of rental homes and provide revenue for housing initiatives.

Finance Minister Carole James said in September that the province collected $115 million from the tax in the 2018-19 fiscal year. She said 99.8 per cent of B.C. residents were exempt.

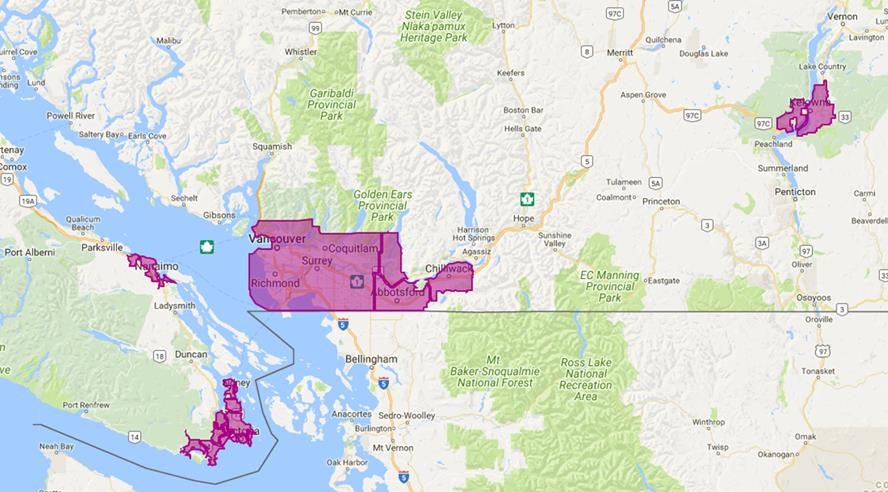

The tax affects only properties in the Greater Victoria, Nanaimo, Central Okanagan, Fraser Valley and Metro Vancouver areas. All property owners are required to file a declaration, which is used to determine whether the tax should be paid.

The commissioner’s office opened an inquiry after receiving complaints the Finance Ministry had exceeded its authority by collecting social insurance numbers on the declarations. The office also received letters of concern about collection, use and disclosure of names, addresses, dates of birth and email addresses.

Adjudicator Erika Syrotuck said she was satisfied that the information collected relates to and is necessary for administering the tax.

Atherton argues there are no agreements for the province to use social insurance numbers. He also wants to know why it thinks it can look at incomes.

“I always thought income tax returns were confidential,” Atherton said. “They’re using it for an inappropriate purpose and violating our privacy rights.”

In her ruling, Syrotuck agreed with the Finance Ministry that a social insurance number was necessary to determine whether the filer was Canadian and to calculate tax owing. Syrotuck said the province is not required to get federal approval to use social insurance numbers, and that B.C. can share information collected with the Canada Revenue Agency under agreements.

Atherton disagrees with many of the commissioner’s findings and wants to challenge them, but “I’m not going to put up the money. I have no legal expertise.”

He maintains the legislation poorly defines what is needed for administration of the tax. “They just delegated an administrator to collect whatever he bloody well felt necessary.”

— With a file from The Canadian Press